The Presidential Election and Financial Markets

Aug 12, 2024The relationship between U.S. presidential elections and stock market performance has long been a concern for many investors. With the 2024 U.S. presidential election experiencing unprecedented turmoil in recent weeks, it is understandable that investors are wondering what impact the uncertainty might have on financial markets. While elections can cause short-term fluctuations in the stock market, it is important to note that the outcome of past presidential elections has not significantly impacted long-term financial trends. In this blog post, we will explore the relationship between elections and financial markets, and highlight what investors need to know.

Markets Tend to Rise in Election Years

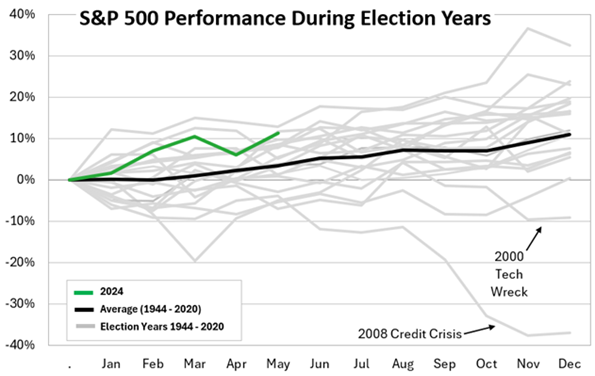

Historically, the U.S. financial markets have risen in election years. According to research by Fidelity Investments, U.S. stocks have averaged returns of 9.1% in election years, dating back to 1950. During that span, only two election years (2000 and 2008) experienced negative returns for the S&P 500. Both market declines resulted from external factors and economic conditions that transcended the election cycle (the tech bubble in 2000, and the Great Recession in 2008).

S&P 500 index measures the performance of 500 stocks generally considered representative of the overall market. Source: Morningstar Direct.

Partisanship and Market Performance

Given the emotional nature of politics, many investors feel that the election outcome should have a significant impact on stock market performance. However, while it may be possible to anticipate each party’s or candidate’s potential policies at a high level, knowing these policy priorities does not necessarily result in an ability to forecast the performance of a company, a sector, or the broad market. In addition, there are major differences between the proposals made on the campaign trail and eventual policy changes; it is rare that a candidate will be able to deliver once in office the exact policies proposed during a campaign. Therefore, it is a risky proposition to make investment decisions based on these proposals or attempt to time the market.

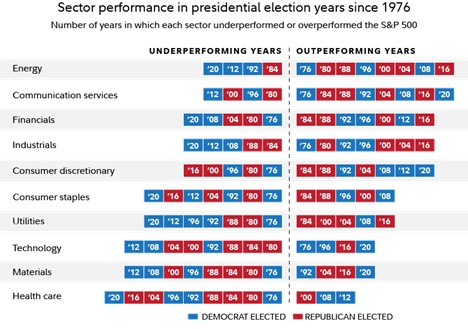

The following chart shows the performance of various economic sectors in election years compared to the S&P 500 since 1976. The results demonstrate the unpredictability of sector performance regardless of which party was elected.

Past performance is no guarantee of future results. Each box represents 1 calendar year of performance for a calendar year that included a US presidential election. Underperforming indicates that price performance was lower than the S&P 500, while outperforming indicates price performance exceeded the S&P 500. Color of each box indicates whether a Democrat or Republican candidate was elected to the presidency that year. Real estate is omitted due to a lack of sufficient performance history, as it was not established as an independent sector until 2016. Each sector is represented by companies included in the S&P 500 that are classified as members of the sector. Source: Strategas Research Partners, as of November 5, 2023.

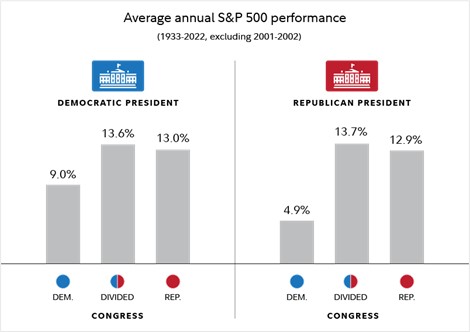

While investors focus primarily on the presidential election, arguably just as important are the congressional races, which could alter the currently slim majorities in both houses of Congress. Even though the S&P 500 has historically averaged positive returns no matter which party held the presidency, a divided government has correlated with stronger market returns. Market volatility typically occurs with uncertainty, and government gridlock helps create less policy uncertainty.

Past performance is no guarantee of future results. Data excludes 2001 to 2002 due to Senator Jeffords changing parties in 2001. Calendar year performance from 1933 through 2022. Source: Strategas Research Partners, as of November 5, 2023.

Focus on Fundamentals and Have a Financial Plan

It is crucial to recognize the other factors that will have a greater impact on investors’ portfolios, such as the economy, inflation, and corporate earnings. While there have been and will be surprising headlines regarding the presidential election, economic fundamentals will drive returns in the long term. Rather than trying to time political or market cycles, we believe investors should have a diversified portfolio based on their financial goals and risk tolerance. Historically, the market has shown resilience and growth over extended periods of time. Most importantly, everyone should have a financial plan that is suited to their goals and is updated regularly.

At Glassy Mountain Advisors, we are here to help clients pursue their financial goals, navigate market uncertainty, and plan for the future. Please contact Matt Altman (maltman@glassymountainadvisors.com) with any questions or planning needs.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results.

The Standard & Poor’s 500 (S&P 500) Index is a free-float weighted index that tracks the 500 most widely held stocks on the NYSE or NASDAQ and is representative of the stock market in general. It is a market value weighted index with each stock’s weight in the index proportionate to its market value.

Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

Diversification does not guarantee a profit or protect against a loss in a declining market. It is a method used to help manage investment risk.