Teaching Financial Literacy to Teenagers

Oct 26, 2023With the increasing complexity of the modern financial world, it is critical that we equip our youth with the knowledge and skills they need to make informed decisions about money. Financial literacy is a crucial life skill that teenagers often lack, and the importance of teaching these skills early cannot be understated. October is “Financial Planning Month.” Considering the month’s theme, this blog will explore the importance of teaching financial literacy to teenagers and young adults, and provide practical tips for setting them up for brighter financial futures.

The Importance of Financial Literacy

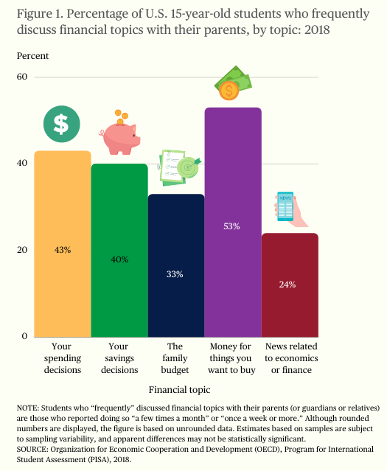

According to studies by the Program for International Student Assessment (PISA), focused on analyzing the financial literacy of 15-year-olds in the United States, only 24% of teens reported frequently discussing news related to economics or finance with their parents. Only 12% of 15-year-old students in 2018 were “top performers” in financial literacy, which PISA defines as those having “the knowledge and understanding of financial concepts and risks, and the skills, motivation, and confidence to apply such knowledge and understanding in order to make effective decisions across a range of financial contexts, to improve the financial well-being of individuals and society, and to participate in economic life.”

When it comes to money management, teenagers generally lack confidence in personal finance topics and yearn for more financial education. According to a Greenlight Study, nearly three out of four teens (74%) reported that they don’t feel confident in their personal finance knowledge, and about the same percentage (73%) reported that they wanted to learn more. Meanwhile, just over half of teenagers say they are learning about these topics at school. While more states are requiring economics and personal finance curriculum, it is ultimately up to parents to foster their kids’ personal finance education.

Tips to Build a Strong Foundation

Discussing money with your kids:

- When teenagers understand the basics of budgeting, saving, investing, and managing debt, they are better equipped to make smart financial decisions and be independent.

- Many teenagers spend money on items and experiences, such as buying food or going places with their friends. These real-world events provide an opportunity for parents to start talking about money.

- Practice transparency

- Parents often keep their finances private, which can make the topic uncomfortable for their children.

- Parents can foster their kids’ relationship with money by discussing their own challenges and mistakes.

- Parents can hold their kids accountable to achieving financial goals, such as a specific monthly savings goal or saving for a big purchase.

Budgeting:

- Needs vs. wants

- Differentiating between needs and wants can help teenagers make better spending decisions and prioritize savings.

- A “need” can be summarized as food, clothing, or shelter.

- A “want” is something nice to have, such as travel, or buying the newest smartphone or laptop.

- Avoiding unnecessary purchases will help teenagers manage their money and avoid falling into debt.

- Living below one’s means

- When teenagers start working, it is tempting to build a budget based on their paycheck. Parents should encourage their teens to set specific savings goals and live below their means.

- Setting goals

- By establishing concrete goals for both the short-term and long-term, teenagers will learn to better manage their money.

- A savings goal can be anything from an emergency fund to a vacation.

- By breaking goals into smaller steps, teenagers can monitor their progress and maintain accountability.

- For example, let’s say that a teenager wants to spend $1,000 on a new laptop a year from now. They would need to set aside about $83 per month to achieve their goal.

- Take advantage of technology

- There are many apps available to help track, monitor, and categorize spending.

- By using a budgeting app, teenagers can rely on technology to do a lot of the work for them and review periodically.

- Mint and Simplifi are two examples of budgeting apps.

- Consider taxes – gross pay vs. net pay

- When teenagers get their first paycheck, the numerous deductions and net pay can be a wake-up call.

- In calculating a budget, one must account for federal taxes, state and local taxes, FICA, and retirement account contributions. While it may be tempting to set a budget based on a gross salary of $50,000, young adults may overestimate their cash flow when their take-home pay is only $37,500.

Saving and Investing:

- Optimize interest on savings

- In today’s higher interest rate environment, parents should guide their teenagers to find a savings vehicle that provides an attractive and competitive interest rate.

- High-yield savings accounts and money markets are currently paying around 4-5% APY.

- Don’t wait to invest

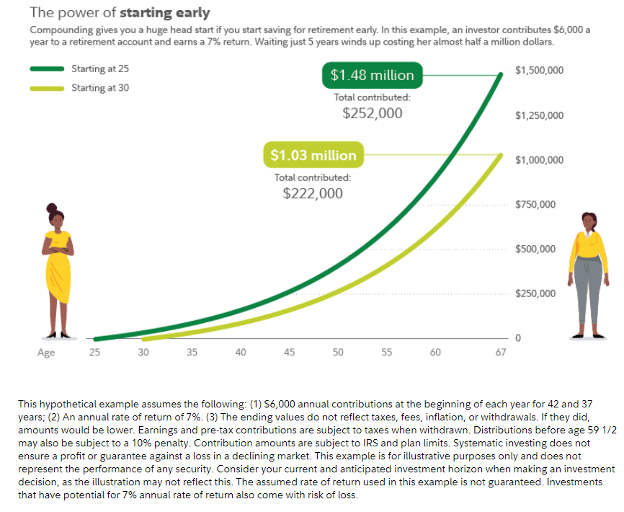

- One of the most important lessons parents can instill in their kids is that time is on their side when it comes to investing.

- Over time, compound interest is powerful. Whether teenagers are saving in a bank account or investing, compounding will allow them to significantly grow their initial deposit over time.

- For example, at age 25, one investor contributes $6,000 a year to a retirement account and earns a 7% annual return. By age 67, they will have nearly $1.5 million.

- Alternatively, another investor starts investing at age 30 and contributes $6,000 a year to a retirement account and earns a 7% annual return, the same return as the first investor. By age 67, this investor has just over $1.0 million, about $500,000 less than the first investor who started earlier.

*Source: Fidelity Investments

- Understand different types of investment accounts

- Taxable

- A taxable account allows one to invest with after-tax dollars and is not subject to special tax treatment.

- These accounts do not have contribution limits, and automatic investment plans can be established to make regular investments.

- Individual Retirement Accounts (for those with earned income)

- Assuming a teenager has a job and reports earned income, they may be eligible to start saving for retirement through an IRA.

- IRA contributions are subject to annual limits, currently $6,500 per year for those under 50.

- A working teenager may contribute the lesser of their earned income for the year or $6,500.

- Ideally, these accounts cannot be distributed until at least age 59 1/2 without penalty.

- Traditional IRA

- A traditional IRA allows one to save money for retirement with tax advantages.

- Generally, traditional IRA contributions may be tax deductible and grow tax deferred, along with earnings, until withdrawn.

- Roth IRA

- A Roth IRA also has unique tax advantages and may be one of the best ways for teenagers to save for retirement, given their long investment time horizons.

- Roth IRAs are funded with after-tax dollars and grow tax-free, along with earnings.

- For teenagers, a Roth IRA can be more flexible than a traditional IRA, since contributions can be withdrawn penalty-free if the account has been open for at least 5 years.

- Assuming a teenager has a job and reports earned income, they may be eligible to start saving for retirement through an IRA.

- Taxable

Borrowing:

- Understanding different types of debt:

- It is essential to teach teenagers the difference between good and bad debt.

- Good debt, such as student loans, could allow a teenager to get an education that could lead to better jobs and higher earning potential.

- On the other hand, over-spending on high-interest credit cards can be detrimental to long-term financial success.

- Establishing a credit score:

- One of the best tips for helping teenagers begin their financial journey is establishing credit.

- One’s credit score reflects how well finances are managed, and a good score goes a long way towards achieving future goals such as a buying car, renting an apartment, or getting a mortgage.

- Parents should guide their kids to use a credit card to make only purchases that can be paid off in full within their 30-day billing cycle.

- Over time, proper use of a credit card helps to establish a good credit score and opens future financial opportunities.

Teaching financial literacy to teenagers and young adults is an important investment in their future success, well-being, and independence. The earlier a child learns about the basics of personal finance, the longer they have to reap the benefits. At Glassy Mountain Advisors, we are here to help you and your family. For questions about financial literacy or planning, please contact Matt Altman (maltman@glassymountainadvisors.com).