Silicon Valley Bank, the Markets, and Your Portfolio

Mar 16, 2023Silicon Valley Bank, the Markets, and Your Portfolio

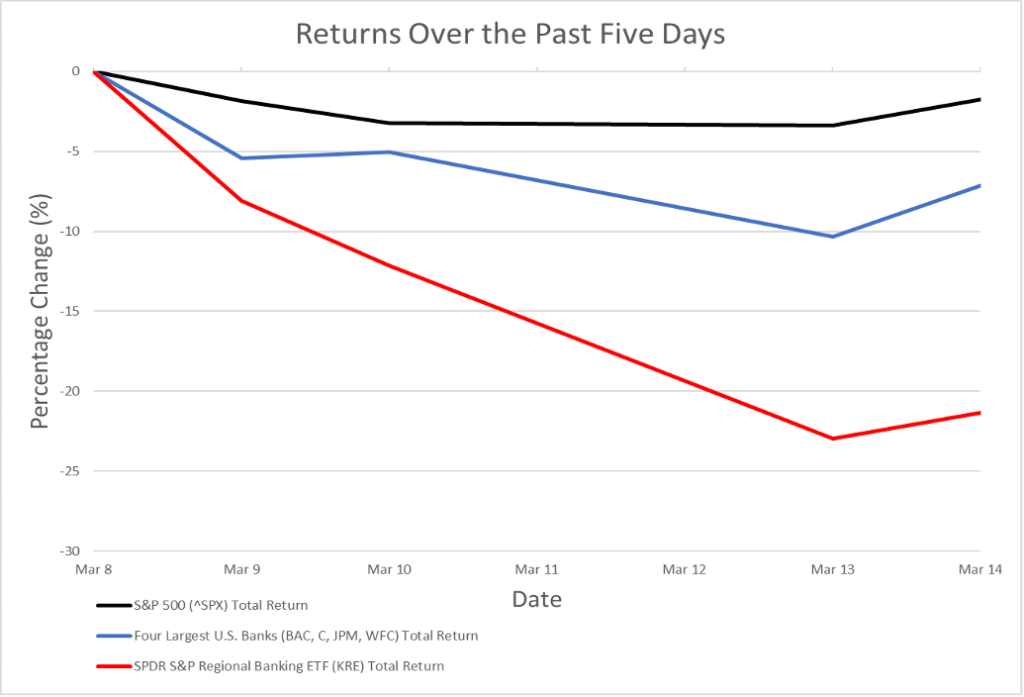

If you have been watching the news the past few days, you have likely seen headlines mentioning the collapse of Silicon Valley Bank (SVB) and the impact on other regional banks and the markets. With the story continuing to develop, we want to clarify what is happening and what it means for you. It is important to note that while there has been major volatility recently in the regional banking sector, the overall market and largest banks have held up relatively well.

Source: YCharts

Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

The Standard & Poor’s 500 Total Return Index (SPTR) is an unmanaged group of securities considered to be representative of the stock market that tracks capital appreciation as well as distributions. It is a market value weighted index with each stock’s weight in the index proportionate to its market value. The Total Return index assumes that all cash distributions (dividends and/or interest) are reinvested.

What is the Silicon Valley Bank collapse?

Before Friday, many people had never heard of Silicon Valley Bank, so why has it become the center of every news cycle? SVB was a unique bank, as it catered specifically to technology and healthcare startup companies. As of last week, SVB was the 16th largest bank in the United States.

The bank enjoyed rapid growth during the COVID-19 pandemic, tripling its deposits from 2019 to 2021. Many companies funded with venture capital kept large deposits at SVB, gradually drawing on these deposits to fund operations. When deposits started flowing into SVB faster than the bank could make new loans to clients, SVB purchased long-term Treasurys and other investments typically viewed as safe.

As venture capital funding dried up and interest rates rose sharply over the past year, increasing the cost of borrowing, many of SVB’s clients turned to their bank deposits to fund operations sooner and faster than SVB management had expected. SVB had to sell long-term Treasurys to meet the withdrawal demands, just as the increase in interest rates caused the value of these long-term Treasurys to drop.

As word spread that SVB was selling securities at a large loss, venture capital firms encouraged the companies in which they had invested to rush to withdraw funds from SVB, leading to a rapid run on the bank and its ultimate collapse. The ease with which clients could withdraw funds using their phones or other technology increased the speed of the run on SVB, overwhelming the bank.

Federal Deposit Insurance Corporation (FDIC) coverage and policy response

When the FDIC shut down SVB midday Friday, many wondered what would happen to deposits above the FDIC’s insurance threshold. Bank deposits are insured by the FDIC up to $250,000, but many SVB depositors held significantly more in their accounts. Over the weekend, however, federal regulators acted quickly and assured that all deposits, insured or not, would be available on Monday. The FDIC also took over Signature Bank, another regional bank with large exposure to the cryptocurrency sector.

The FDIC, a congressionally mandated and independently funded government agency, will be drawing on the $128 billion Deposit Insurance Fund, an accumulation of money that banks are required to pay as premiums so that the agency can reliably provide protection for deposits in times of distress. The Federal Reserve also announced that it would offer short-term loans to banks on favorable terms to provide more support and help banks meet any withdrawal demands.

How will other banks and the economy be impacted?

Investors have punished the shares of regional banks in the past several days. While the government backstop on SVB seems to have prevented catastrophic runs on other regional banks, it does appear that concerned clients of these banks have been moving some deposits to larger banks considered to be safer. Partly due to this transfer of deposits, the shares of these larger banks have not declined as much as those of the regionals.

Time will tell how and when new regulations may arise from the collapse of SVB. In the near term, the Fed may slow or stop its interest rate hikes in order to avoid further disruption to the economy and markets. The cost to banks of deposit insurance will also likely increase, one way in which other banks will pay for SVB’s collapse.

What does this mean for me?

We believe the custodians of our clients’ assets, Charles Schwab and Fidelity Investments, are financially strong and are not exposed to the current issues to a degree that would lead to significant problems. The combination of SVB’s client base, rising interest rates, and SVB leadership’s poor risk management is specific to SVB and perhaps a few other banks. Although Schwab’s stock has had recent volatility, the firm has seen significant asset inflows, invests in shorter-term assets, and has a relatively low loan-deposit ratio. We have examined Schwab’s most recently released financial statements and are confident that it is well capitalized and will continue to be a responsible custodian of assets held there. Unlike the smaller SVB, Schwab is subject to additional regulatory requirements and stress tests designed to ensure financial stability.

It is also important to understand that Schwab and Fidelity do not comingle clients’ brokerage assets with their own, unlike banks. Under the SEC’s Customer Protection Rule, brokerage firms must maintain custody of clients’ securities and safeguard clients’ cash by keeping those assets separate from the firm’s proprietary business activities.

These recent events, while troubling, do not change our view that markets will eventually recover and that staying invested in a well-diversified portfolio is critical to long-term success. We will continue to monitor the situation closely and make adjustments, if necessary. As always, please contact the Glassy Mountain Advisors team with any questions or concerns.

Exchange Traded Funds (ETF’s) are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from the Fund Company or your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

This blog contains general information that may not be suitable for everyone. The information contained herein should not be construed as personalized investment advice. Past performance is no guarantee of future results. There is no guarantee that the views and opinions expressed in this blog will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Diversification does not guarantee a profit or protect against a loss in a declining market. It is a method used to help manage investment risk.