Quarterly View: September 2021

Oct 13, 2021Sliding into Fall

The steady upward trend of the stock market through the summer months cooled along with the weather in September. As concerns mounted over the impact of the Delta variant of COVID-19 on the economy, conflict over the debt limit and other matters in Washington, signs that inflation may be more persistent than hoped, and regulatory and real estate issues in China, the stock market responded with a decline. We are optimistic that the headline issues will not significantly derail economic growth and the markets, but we expect more market volatility ahead.

Third Quarter Notes

Stocks started the third quarter on a roll. Progress in vaccinating the U.S. population spurred economic activity, which boosted corporate profits. Investors responded by bidding up stocks to more record highs, and the S&P 500 index extended its gains for the year through the end of August to 21.6%, including dividends. Bond yields remained near historical lows, with the yield on the 10-Year Treasury falling to 1.2%.

The stock market declined in September, however, due to rising concerns over several important issues. The Delta variant of COVID-19 brought a surge in cases and deaths, particularly in areas with lower vaccination rates, which led many people to curtail activities they had briefly resumed in the spring and early summer. Also, federal government relief programs for many affected by the pandemic ended in early September, raising concerns that consumers may reduce spending. As a result of these and other concerns, economists lowered forecasts for gross domestic product (GDP) growth, and analysts reduced earnings estimates for the first time since December 2020.

Supply chain constraints, a tight labor market, and rising prices for energy and manufacturing inputs caused some companies to temper their earnings outlooks, giving investors another reason to sell stocks. U.S. inflation measures came in higher than many expected, and even U.S. Federal Reserve Board Chair Powell admitted that inflation was likely to be an issue for longer than he had predicted. In response, bond yields rose as bondholders demanded greater protection from future inflation.

Not to be outdone, Congress provoked further market disruption by battling over infrastructure spending and the debt limit. Treasury Secretary Yellen warned that the United States would not be able to meet its obligations beyond October 18th without a debt limit increase, setting a deadline for Congressional action.

The S&P 500 index ultimately managed to eke out a slight gain for the third quarter, leaving the index up 15.9% for the year so far and about 5% off its peak. The yield on the 10-Year Treasury rose to 1.5%, and the Barclays US Aggregate Bond Index ended off 1.6% for the year through September.

Outlook

The issues that caused recent market volatility will likely persist over the coming months, and some will take longer to resolve.

The ongoing pandemic and political disfunction present new challenges to a U.S. economic recovery that was already forecasted to moderate. Nevertheless, we expect resolution of some of the current headline issues and a renewed focus on what remains a mostly healthy economy and increasing corporate earnings.

While the Delta variant has disrupted plans for a return to normal activities for many, cases and deaths in the United States are now on the decline. This news is welcome to all, especially overwhelmed health care workers and facilities. Availability of booster shots for the most vulnerable should help mute a potential winter spike in cases. Promising results from trials of Merck’s antiviral pill also give hope for effective treatment for those who contract COVID-19 in the future.

We are relieved that Congress raised the debt limit, at least temporarily, and believe Congress will act again to avoid default. We also expect Congress and the White House to agree on infrastructure and other spending plans that will provide a boost to the economy through government spending. The amount of spending and corporate tax increases will probably both be less than some are seeking, but we think the overall result will help the economy.

As it announced in September, the Fed will likely begin tapering bond purchases as early as November, an important element of its support for the U.S. economy. Chair Powell and his colleagues will need to carefully balance the Fed’s actions to ward off large increases in inflation while also maintaining support for the economy to help reduce unemployment.

Economists expect U.S. GDP growth of about 6% for all of 2021, which represents a decrease from estimates of 6.5% in June but would still be the highest rate since 1984. Corporate earnings growth should slow but remain strong. Analysts forecast an earnings increase of about 28% for the third quarter and 22% for the fourth. Important to note is that analysts’ estimates of earnings rose throughout the year, a departure from the usual trend, though estimates did decline slightly in September.

Looking abroad, we are keeping a close eye on China, where increasing regulatory scrutiny and troubled real estate investments are contributing to forecasts for slowing economic expansion. Europe is making good progress with vaccinations, and governments are still providing economic support that should help maintain the recovery there.

Current Opportunities

The S&P 500 index currently trades at about 21 times estimated earnings for the next 12 months, a slight decrease over the past few months due to the pullback in the market and simultaneous increase in earnings estimates. We continue to find attractive opportunities among domestic stocks, particularly after the recent market decline, and see good potential for long-term gains in developed and emerging foreign markets. In our opinion, stocks offer the best protection against the possibility that inflation may stay elevated longer than expected.

As noted previously, interest rates have risen over the past month, making bonds slightly more attractive. We prefer the higher yields of the dividend equities in our portfolios, however, and are limiting our bond exposure until conditions are more favorable.

Overall, we expect economic and market conditions to improve during the fourth quarter. Stocks have the potential to add to the year’s gains, but we also acknowledge that another downturn could come at any time. We remain optimistic that our clients’ portfolios will prove resilient and perform well through the market’s cycles, and we look forward to adding new securities as we see good opportunities.

Analysis of Selected Securities

Following is a discussion of three securities we own and have bought recently. Due to factors specific to each company, these stocks are, in our opinion, priced attractively in the markets today.

Apple Inc.

- Price (9/30/2021): $141.50

- Market Cap ($T): $2.4

- Dividend Yield: 0.6%

- Return on Equity: 127.1%

- Forward P/E: 25.5

- Price/Book: 36.5

- Price/Sales: 7.0

- Debt/Equity: 1.7

Consumer electronics giant Apple is best known for the iPhone as well as other devices such as the iPad tablet, AirPods wireless earbuds, Mac personal computers, and the Apple Watch. Most of Apple’s total revenue comes from hardware sales, with iPhones alone accounting for more than 50%, and the company also provides software and services including Apple Music, iCloud storage, iMessage, FaceTime, Apple TV, and Apple Pay. Apple is currently the largest company in the S&P 500 index, with a market capitalization of $2.4 trillion.

We believe Apple’s primary competitive advantage is its ability to design premium, visually appealing devices that integrate with its user-friendly software and services into one technological ecosystem. Because Apple’s products and services work together so seamlessly and do not function as well with other manufacturers’ devices, it is difficult for users to switch to other devices, resulting in extremely high customer loyalty.

Apple’s active installed base reached 1.7 billion devices worldwide at the end of 2020, up 10% from the prior year, showing the popularity of the company’s products and strength of its brand. This brand value and the company’s powerful technological ecosystem allow Apple to consistently charge premium prices, unlike most of its peers. Accordingly, Apple has historically generated strong operating margins and returns on invested capital that are above market averages.

This year, Apple has experienced strong double-digit growth across all of its major product lines. This growth is the result of work- and learn-from-home trends and increased demand for hardware during the pandemic. The company also announced the launch of new iPhone, iPad, and Apple Watch models at its annual product showcase in September.

While we believe future growth will be more muted compared to the current year, an expanding market for Apple’s software and services and demand for 5G phones should continue to support increased sales. In addition, Apple’s increased focus on software and services should help boost the percentage of revenue the company derives from higher margin and more sustainable service offerings.

Given these trends, we believe that Apple is attractively valued at 25.5 times projected earnings, a premium to the market that reflects its superior business. The Company has a strong balance sheet, with $194 billion in cash and marketable securities compared to $122 billion in total debt. The shares currently offer a yield of 0.6%, and we expect management to increase dividend payouts and share repurchases over time.

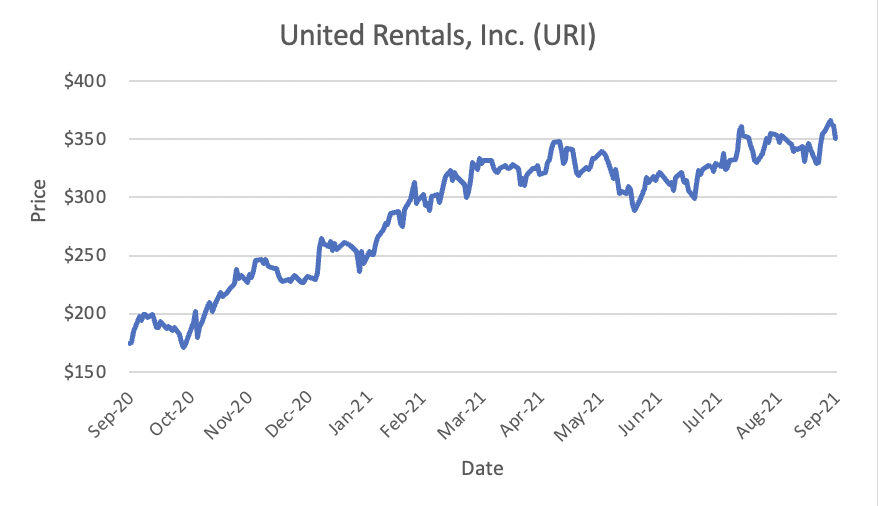

United Rentals, Inc.

- Price (9/30/2021): $350.93

- Market Cap ($B): $25.7

- Dividend Yield: 0.0%

- Return on Equity: 22.2%

- Forward P/E: 14.5

- Price/Book: 4.9

- Price/Sales: 2.9

- Debt/Equity: 2.0

United Rentals is the world’s largest equipment rental company, currently operating approximately 1,275 rental locations in the United States and Canada and others in Europe, Australia, and New Zealand. The company’s diversified rental fleet includes 745,000 units used by customers in the construction and industrial sectors.

The equipment rental industry is highly fragmented, and we believe United Rentals is well positioned to thrive relative to its smaller peers. Management estimates that the company’s market share is 13%, which is greater than the next two largest competitors combined, and there is plenty of room for United Rentals to increase its market share through internal growth and acquisitions. The company’s large scale provides greater purchasing power and enables United Rentals to offer a wider range of equipment and services. The company is also able to increase the utilization and earning potential of its assets by transferring equipment across its vast branch network to match local market demand.

Additionally, United Rentals benefits from an industry shift toward renting rather than buying heavy equipment. The percentage of construction equipment in the United States owned by rental companies stands at just 53%, which is well below the 80% level in countries such as the United Kingdom and Japan. We expect that equipment rental volumes will continue to gradually rise in the United States as businesses increasingly realize the many advantages of renting, including the ability to control expenses and inventory, reduce maintenance and warehousing costs, and ensure availability of the right equipment for any job.

United Rentals expects to generate total revenue of $9.6 billion in 2021, compared to $8.5 billion in 2020, as rental volume trends and equipment utilization continue to improve amid the broader recovery in industrial activity from COVID-19 disruptions. In May, the company completed the $1 billion acquisition of General Finance, a specialty rental services company offering mobile storage and modular office space. This acquisition should improve the company’s competitive advantage, as construction projects often require leasing of both heavy equipment and temporary office space and storage. We expect earnings to increase more than 10% annually over the next three to five years, with additional upside from a potential multibillion-dollar infrastructure-spending bill.

The company’s stock is attractively priced at 14.5 times projected earnings, compared to the industry average of 26.5 times. Management is focused on managing the balance sheet by maintaining ample liquidity and prioritizing debt reduction. Management paused the company’s current $500 million share repurchase program in March 2020 due to the COVID-19 pandemic, but we expect United Rentals will likely resume its share repurchases during 2022 as pandemic pressures continue to ease.

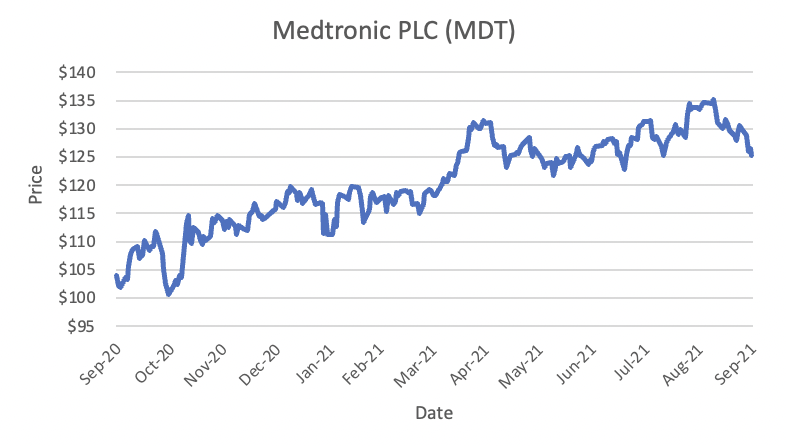

Medtronic PLC

- Price (9/30/2021): $125.35

- Market Cap ($B): $171.5

- Dividend Yield: 2.0%

- Return on Equity: 7.6%

- Forward P/E: 22.0

- Price/Book: 3.3

- Price/Sales: 5.4

- Debt/Equity: 0.5

Medtronic is the largest company in the world focused entirely on medical devices. Medtronic develops and manufactures therapeutic devices both for treatment of chronic diseases and for acute care in hospitals, primarily in the areas of cardiac care, neurological and spinal conditions, and diabetes. The company’s portfolio of products includes pacemakers, defibrillators, heart values, insulin pumps, neurovascular products, and surgical tools. Medtronic markets its products to healthcare institutions and physicians globally, with about half of revenues coming from the United States.

Medtronic’s fundamental strategy focuses on innovation. The company is often first to market with new products and has invested heavily in internal research and development efforts as well as in acquiring emerging technologies. The strength of the company’s patents, its diversified product portfolio, and high switching costs for practitioners have helped Medtronic become a key partner for its hospital customers, who rely on the expertise of the company’s representatives, further solidifying Medtronic’s competitive advantages. We believe the company’s large scale and ability to increase investments in significant research and development programs to expand its product pipeline will allow it to reinforce its strong competitive position and drive growth in the future.

Medtronic’s performance continues to recover from 2020, when revenue fell due to a decline in global procedural volumes as a result of the COVID-19 pandemic. Most of the company’s businesses have performed at or above prepandemic levels during the current year to date period. Management expressed caution about the pace of its recovery, however, as the company experienced a slowdown in elective procedures for certain businesses during the last few weeks of July as a result of the Delta variant of COVID-19. Medtronic expects the Delta variant to impact its U.S. business over the next two quarters, especially in the cardiovascular and neurosciences segments, where many procedures require ICU capacity and can be deferred.

Despite the slowdown projected in the short term, we believe Medtronic’s competitive advantages position the company to generate stable earnings growth over the longer term. Additional opportunities should come from the company’s expansion into high growth surgical robotics and from emerging markets, which accounted for only 16% of 2021 revenue and were growing at a faster pace than other regions prior to the pandemic.

Management has raised dividends for 43 consecutive years and recently increased its dividend by 9%, resulting in a current yield of 2.0%. Currently trading at a price of 22.0 times projected earnings, slightly below its peer group average of 23.4 times, Medtronic is an attractive long-term holding with good return prospects.

Disclosures

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward -looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results.

Indices are unmanaged, and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does xnot account for any fees, commissions, or other expenses that would be incurred.

The Standard & Poor’s 500 Index (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value-weighted index with each stock’s weight in the index proportionate to its market value.

The Bloomberg Barclays US Aggregate Bond Index is a broad-based market capitalization -weighted bond market index representing intermediate term investment grade bonds traded in the United States. Investors frequently use the index as a proxy for measuring the performance of the US bond market.