Quarterly View: October 2022

Oct 14, 2022More Market Blues

Stock market woes continued in the third quarter of 2022 as the issues that previously spooked investors persisted: high inflation, interest rate hikes by central banks around the world, mixed economic signals including signs of slowing global growth, and ongoing war in Ukraine and the resulting impact on energy prices and supply chains. We think the recent volatility will continue until inflation cools significantly and the economic picture becomes clearer. In the meantime, we are looking for opportunities to invest in securities that have fallen in price and offer attractive long-term returns.

Economic and Market Overview

After a rally to start the quarter, stocks reversed course in mid-August and declined through the end of September. The S&P 500 index dropped 4.9% in the quarter, leaving it down 23.9% for the first nine months of the year. Bonds also fell, with the Bloomberg Barclays U.S. Aggregate Bond Index off 4.8% for the third quarter and 14.6% for the year. The yield on the 10-Year Treasury note rose to 3.8%, the highest since April of 2010.

Core inflation has risen 6.6% from a year ago, the highest annual rate since 1982, and fears of recession in the United States and abroad have investors on edge. The U.S. Federal Reserve and other central banks have been increasing interest rates in efforts to curb inflation, and there are signs of slowing economic growth worldwide. The Chinese economy appears to be troubled, partly due to strict lockdowns aimed at controlling the spread of COVID-19 that added to supply chain woes. The war in Ukraine has also exacerbated supply chain issues and led to higher energy prices, which have been particularly damaging to the European economy. Weaker energy demand due to the slowing global economy caused oil prices to decline in the third quarter, but the recent decision by OPEC Plus to cut oil production led to another rise in prices.

The current jobs situation is perhaps the most perplexing part of the U.S. economy, as the Fed’s sharp increases in interest rates have done little to curtail hiring. The most recent report showed a slight slowdown in hiring – 263,000 jobs added compared to an average of 420,000 per month this year – but the number of jobs added was high enough to cause investors to send stocks down on expectations of more aggressive Fed rate increases to cool economic growth. The unemployment rate of 3.5% is extremely low and hardly a typical sign of recession.

Wages have increased by 5% over the past twelve months, which is a large rise but is not enough to keep up with even higher inflation. Job openings fell by 10% in August and layoffs rose, signs that the Fed’s actions to ease tight labor market conditions are beginning to work, but the signals from employment remain mixed.

Source: Bureau of Labor Statistics

We expect the Fed to raise rates further as it attempts to reduce inflation to levels closer to the long-term inflation target of 2% annually. The Fed’s actions will likely include at least one more increase of 0.75%, with the odds of a recession by 2023 increasing as a result of these swift rate hikes.

Corporate earnings increased 6.2% in the second quarter (results were reported in the third quarter), a solid increase but the lowest growth since the fourth quarter of 2020. As the third quarter earnings season begins, we expect earnings to rise about 5%-7%. The rise in the U.S. dollar has begun to hurt domestic manufacturers and others selling goods abroad, since the stronger dollar makes U.S. products more expensive to foreign buyers, a factor increasingly cited by executives in earnings reports. The S&P 500 index currently trades for a multiple of about 15.3 times projected earnings for the next twelve months, below the averages for the past five and ten years and a slight decrease from the multiple at the end of the second quarter.

Perspective

2022 has been a difficult year for investors in stocks, one of those years that challenge investors’ patience and discipline and bring emotions to the forefront. Each such period of falling prices is different from the last, making it hard to predict exactly what will cause stocks to rebound and when the recovery will come.

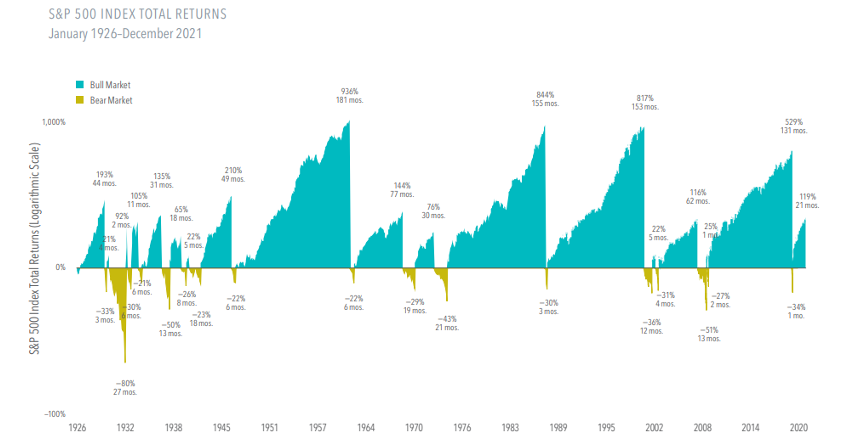

It is important to remember that after each previous market drop, stocks recovered, and we expect history to repeat itself this time. Sometimes the recovery is quick and sharp, as it was after the pandemic-induced pullback in spring 2020. Other times, the rebound takes longer, such as after the dot-com bubble crash. Regardless of the circumstances, stocks have come back and resumed their upward march after the pandemic, financial crises, conflicts including world wars, recessions, depression, and more, as shown in the following chart.

Equities Have Rewarded Patient Investors

Source: Dimensional Fund Advisors, S&P data ©2022 S&P Dow Jones Indices LLC

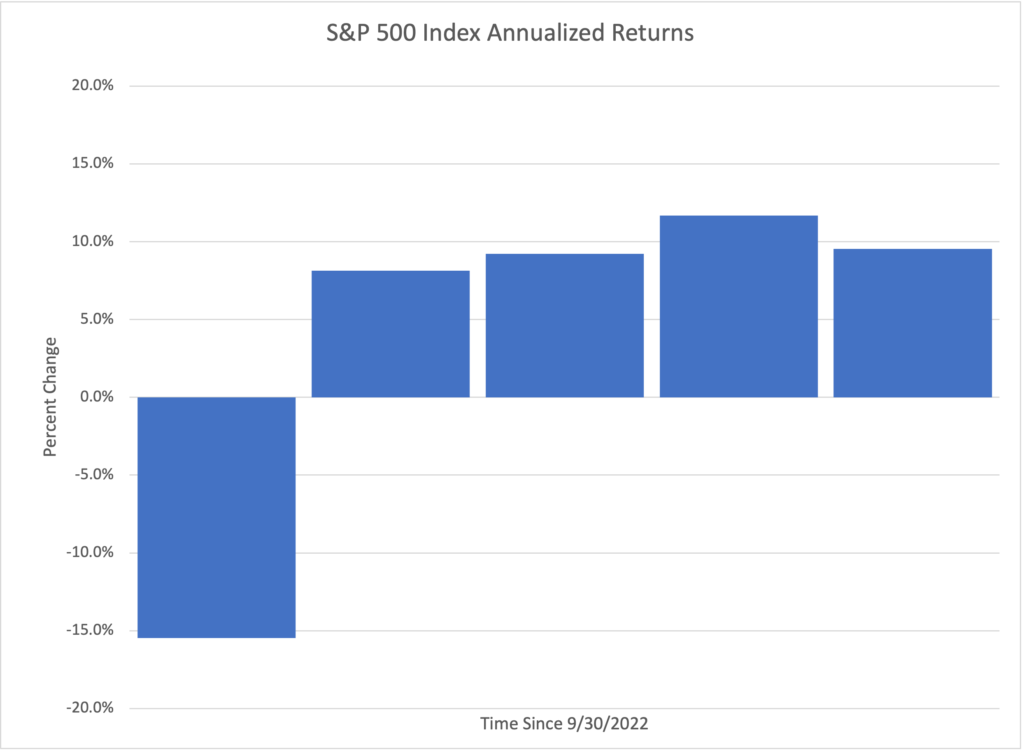

Despite this year’s declines, stock market returns over longer-term periods are still strong following several years of robust performance. The chart below shows the returns for various periods; the average since 1990 has been 10.2%.

Sources: Morningstar, YCharts

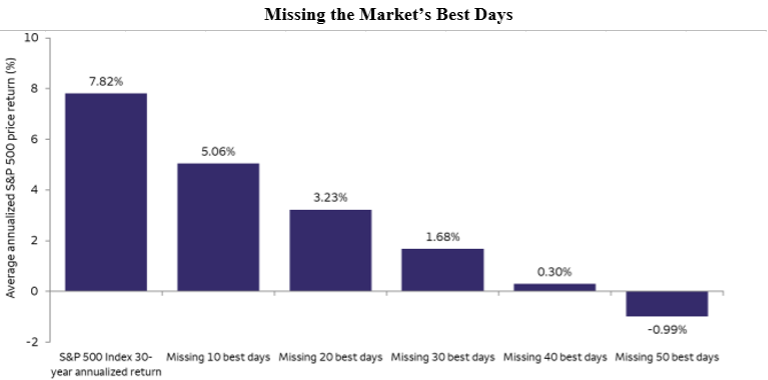

The lesson here for investors is that sticking with a proven strategy that is designed to do well over the long term, through good and bad times in the markets, is the best way to prosper. Trying to predict market returns in the short term too often leads to decisions that hurt long-term portfolio performance. Moves such as selling and sitting on cash while waiting for conditions to improve can be tempting, but they are extremely difficult to execute correctly and consistently in a way that does not lead to worse returns. Missing only a few of the market’s best days, which often occur during a rebound from price lows, can significantly reduce returns, as shown in the following chart.

Sources: Bloomberg and Wells Fargo Investment Institute. Daily data: September 1, 1992 through August 31, 2022 for the S&P 500 Index

Changes to Portfolios

We have largely stayed the course with our portfolios, since we do expect stocks to rebound. The changes we have made recently in the income portion of our portfolios included a switch to two exchange-traded funds (ETFs) to get more diversified exposure to the energy infrastructure sector and preferred stocks. The preferred stock ETF, discussed below in more detail, also provides more liquidity than individual preferred stocks. We continue to keep our eyes open for more opportunities to buy securities that are attractively priced now due to the downturn and offer strong long-term appreciation potential.

Analysis of Selected Securities

The following is a discussion of three securities we own and have bought recently. Due to factors specific to each company, these stocks are, in our opinion, priced attractively in the markets today.

PayPal Holdings, Inc. (PYPL)

Price (9/30/2022): $86.07 Forward P/E: 17.4

Market Cap ($B): $97.1 Price/Book: 4.9

Dividend Yield: 0.0% Price/Sales: 3.8

Return on Equity: 10.1% Debt/Equity: 0.5

Sources: Morningstar, YCharts

PayPal is a technology platform that offers electronic payment solutions to merchants and consumers in more than 200 markets across the globe. The vast majority of PayPal’s more than $26 billion in revenue comes from charging fees for completing payment transactions between members of the company’s payments network. Having a relationship with both the merchant and consumer allows PayPal to offer end-to-end solutions for more than 400 million customers around the world.

PayPal’s core products include digital wallet, checkout, and processing for digital and in-store purchases. These products allow customers to move money from any funding source to a digital wallet and transfer that money as payment for goods to a merchant’s wallet, where it can then be used to fund business activities or moved to a bank account. The online system has an inherent advantage over a physical system in that each transaction is digitally recorded, which creates a large pool of useful data. PayPal invested early in capabilities to establish the company as a trusted partner with industry leading fraud resolution capabilities.

We believe that PayPal will continue to take advantage of rising e-commerce adoption globally and the shift toward digital payments. Additionally, we view PayPal’s pricing model as well protected from the margin deteriorating impact of inflation since the company calculates fees as a percentage of transaction value plus a flat fee. The company is not immune to a general decline in economic activity, but we believe PayPal will at least partially avoid the potential earnings deterioration that many businesses could see if inflation continues to persist.

We welcomed the recent news that Elliott Management, an activist hedge fund, had acquired a large stake in PayPal and planned to advocate for management to refocus the company toward profitable growth while cutting unnecessary expenses. So far, PayPal has announced plans to cut $900 million in expenses over the next year and also authorized $15 billion in additional share buybacks.

After a pullback in price of over 50% during the first half of 2022, PayPal’s price to forward earnings ratio fell to 17.4 times, compared to the average of 37.4 times over the last five years. We decided that this price drop presented an attractive buying opportunity. While we acknowledge that competition is a risk factor for PayPal, we believe that over the long-term PayPal will continue to leverage its payment network, strategically deploy excess cash in a manner accretive to shareholders, and take advantage of the opportunity to expand margins by streamlining operations while increasing revenue.

Booking Holdings Inc. (BKNG)

Price (9/30/2022): $1,643.21 Forward P/E: 14.1

Market Cap ($B): $65.9 Price/Book: 16.6

Dividend Yield: 0.0% Price/Sales: 4.7

Return on Equity: 35.1% Debt/Equity: 2.1

Sources: Morningstar, YCharts

Booking Holdings is the world’s largest online travel agency by revenue. The company offers reservations for hotel rooms, flights, car rentals, vacation packages, cruises, and restaurants through six primary brands: Booking.com, Priceline, KAYAK, agoda, Rentalcars.com, and OpenTable. Transaction fees for online bookings are the primary source of the company’s revenue, with the majority generated in Europe.

Booking and its next largest competitor, Expedia, control approximately 60% of the online travel agency market. The remaining 40% market share is highly fragmented, making it challenging for smaller new entrants to build relationships with hotels and, in turn, attract customer traffic to their booking platforms. What also makes Booking unique relative to competitors is its strong presence in international markets, specifically in Europe where it enjoys a leadership position and a network that would be costly and time consuming for competitors to replicate. International markets tend to have more boutique than branded hotels, a situation that usually leads to stickier relationships since boutique hotels rely more heavily on travel agencies like Booking to market and attract reservations. Independent hotels represent more than half of the hospitality market in Europe, compared to about one third in the United States.

After a major slowdown during 2020 and much of 2021, travel demand rebounded in 2022 given the ongoing COVID-19 recovery and reduction in government-imposed travel restrictions. Booking reached another milestone in its recovery from the impact of the pandemic when reservations for room nights for the second quarter of 2022 surpassed 2019 levels for the first time. However, despite a busy summer travel season, management noted a moderation in room night growth in July.

While we believe that factors such as the Ukraine war and high inflation may weigh on consumer sentiment and discretionary travel spending over the short term, we are optimistic about Booking’s long-term prospects. Online penetration in the travel booking market remains below 50%, and we believe that Booking is well positioned to benefit from the increasing global shift to online bookings as it expands its network in both developed and emerging markets. Furthermore, management continues to invest in its payment platform as part of a strategy to offer a more connected trip, in which customers can bundle accommodations and experiences, that should help Booking capture more wallet share over time.

With shares currently trading at a forward price to earnings ratio of 14.1 times, below their historical 10-year average of 21.7 times, we believe Booking is attractively priced relative to its long-term prospects. We also value Booking’s strong balance sheet, with healthy cash reserves and financial flexibility to help it mitigate the travel industry’s cyclical nature.

First Trust Preferred Securities and Income ETF (FPE)

Price (9/30/2022): $16.70

Net Asset Value (9/30/2022): $16.82

Assets Under Management ($B): $6.1

Annual Expense Ratio: 0.9%

Distribution Rate: 5.5%

Sources: Morningstar, YCharts, First Trust Advisors

The First Trust Preferred Securities and Income ETF is an actively managed exchange-traded fund that invests the majority of its assets in preferred securities as well as other income-producing debt securities such as convertible securities, high yield securities, and corporate bonds. The fund’s goal is to obtain an attractive total return through a diversified investment in high quality preferred securities.

Preferred securities combine some characteristics of both common stocks and bonds. Holders of these securities have a higher priority to a company’s earnings than common stockholders but fall behind bondholders’ claims in the corporate capital structure. Additionally, preferred securities tend to pay a fixed or adjustable rate of return, like bonds; however, they generally do not participate in a company’s earnings growth and the resulting common stock appreciation. As a result, most preferred securities are priced similar to corporate bonds with slightly higher credit risk due to their lower standing in the capital structure. Generally, an issuing company must pay all dividends on its preferred securities before additional earnings are made available for distribution to common stockholders.

Historically, financial services firms have been the primary issuers of preferred securities, since many of these firms issue preferred shares to meet their capital requirements without increasing their debt load or diluting their common shareholders. Preferred securities are also common with firms in the utilities, telecom, energy, and industrials sectors.

In our view, preferred securities are an attractive source of income relative to other income-producing securities given their hybrid nature. They tend to produce a more stable stream of income and have been less volatile compared to high-yielding stocks given their seniority in the capital structure. Furthermore, since issuers pay preferred dividends with after-tax corporate profits, these dividends are usually classified as qualified dividend income and taxed at lower rates than bond income.

Although the First Trust Preferred Securities and Income ETF has not been immune to the broader sell-off in fixed income markets during 2022, we believe the high yields of preferred securities relative to other fixed income asset classes and pullback in market prices below par value provide an improved risk reward balance for preferred securities relative to the beginning of the year. In our opinion, interest rate volatility has increased the importance of active management, and we value the fund’s tilt towards selecting variable rate securities that it believes will have the greatest upside potential. Approximately 80% of the portfolio is invested in floating or fixed-to-floating rate preferred securities, an allocation we believe is prudent given the current interest rate hiking cycle and possibility that the Federal Reserve may keep rates elevated for a longer period of time than previously expected.

We believe that preferred securities make up an important component of income-oriented portfolios and have maintained exposure to these securities in client portfolios by swapping individual preferred securities with the First Trust Preferred Securities and Income ETF. We felt comfortable making the switch given the broader diversification and liquidity available from the fund, which holds more than 300 securities, as well as our favorable view of the portfolio’s active positioning for the current interest rate environment.

Additions to the Glassy Mountain Advisors Team

We are pleased to announce the recent addition of three new colleagues to our team. Matt Altman, CFP®, based in Raleigh, provides financial planning services and manages client relationships. Mike McIntyre and Will McCaffrey, both based in Bethesda with Jessica, Brian, and Jordan, assist with research, trading, and portfolio management. Will also supports Matt and Jordan in managing client relationships. We are excited to have Matt, Mike, and Will with us and look forward to introducing them you to over the coming months.

Disclosures

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results.

Indices are unmanaged, and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions, or other expenses that would be incurred.

The S&P 500 index is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value-weighted index with each stock’s weight in the index proportionate to its market value.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. Investors frequently use the index as a proxy for measuring the performance of the U.S. bond market.

Exchange-traded funds (ETFs) are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from the fund company or your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

The S&P SmallCap 600 Index is an index of small-capitalization stocks managed by Standard and Poor’s. It tracks a broad range of small-sized companies that meet specific liquidity and stability requirements, determined by specific metrics such as public float, market capitalization, and financial viability, among a few other factors.

The Russell 2000 Index is an unmanaged index that measures the performance of the small-capitalization segment of the U.S. equity universe.

A REIT is a security that sells like a stock on the major exchanges and invests in real estate directly, either through properties or mortgages. REITs receive special tax considerations and typically offer investors high yields, as well as a highly liquid method of investing in real estate. There are risks associated with these types of investments and include but are not limited to the following: potential difficulty discerning between routine interest payments and principal repayment; redemption price of a REIT may be worth more or less than the original price paid; value of the shares in the trust will fluctuate with the portfolio of underlying real estate; and involves risks such as refinancing in the real estate industry, interest rates, availability of mortgage funds, operating expenses, cost of insurance, lease terminations, potential economic and regulatory changes. This is neither an offer to sell nor a solicitation or an offer to buy the securities described herein. The offering is made only by the prospectus.