Quarterly View: April 2022

Apr 13, 2022Stocks Take a Breather

After rising steadily for two years, the stock market finally declined in the first quarter of 2022 in the face of war in Ukraine, persistently high inflation, and the initiation of interest rate increases by the U.S. Federal Reserve. While never enjoyable, occasional market pullbacks are inevitable. This particular one comes after an extraordinarily strong run for stocks since the onset of the COVID-19 pandemic in early 2020.

As we begin the second quarter, stocks have recovered from the depths of mid-March. The same challenges remain, however, and the risk of recession is rising. We expect more volatility in the near term and are looking for opportunities to purchase shares that are trading at significant discounts and offer the potential for healthy long-term returns.

First Quarter Review

After a tremendous gain of nearly 29% in 2021, stocks started to drop in January and hit a bottom by mid-March. Down about 12% at the low point, the S&P 500 index experienced an official correction, or decline of more than 10%. Stocks then recovered sharply, and the S&P 500 index ended the quarter with a loss of 4.6%, including dividends. Meanwhile, bond prices dropped as interest rates rose. The Bloomberg Barclays U.S. Aggregate Bond Index lost 5.9% during the first three months of the year, the worst quarterly performance in over 40 years.

Rising inflation and the Fed’s plans to increase interest rates and shed assets were already weighing on investors as the year began. During the first quarter, supply chain issues and strong demand from consumers emerging from pandemic lockdowns drove up prices for many goods. Core inflation rose to levels not seen since the early 1980s, including a 6.5% annual increase in March. Employers continued to struggle to fill open jobs due to the tight labor market, and employment returned to close to pre-pandemic levels. Wages rose as a result, adding to inflationary pressures.

The Fed ended its bond purchases in March and increased the federal funds rate by 0.25%, as planned. Both of these moves were important changes from the stimulative policies the Fed began in 2020 to battle the economic effects of the pandemic. As concerns about inflation mounted, the Fed also stepped up its plans to increase interest rates further, raising concerns that these efforts could tilt the economy into a recession.

As if the potentially overheating economy and ongoing supply chain issues were not challenging enough, Russia’s invasion of Ukraine on February 24th gave investors another reason for concern. The war exacerbated supply chain problems and caused oil prices to spike, both of which added to inflationary pressures. The United States and its allies responded to the invasion with sanctions on Russia but have been wary of measures that would potentially harm their own economies. President Biden also tapped into U.S. oil reserves to try to tame gasoline prices.

Finally, COVID-19 continued to have a negative impact on the global economy. A surge in cases from the Omicron variant at the end of 2021 caused consumers to curtail some activities and spending. New cases have since waned in the United States and other areas of the world, but the Chinese government’s strict lockdowns intended to prevent COVID-19’s spread have slowed economic growth locally and exacerbated supply chain issues.

Outlook

Given the combination of challenges in the first quarter, perhaps it is surprising that the market ended down only 6% below its all-time high. These challenges remain critical factors as we start the second quarter and look further ahead, and we expect the recent volatility in markets to continue.

We will be watching closely to see whether the Fed is effectively able to tame inflation without sending the U.S. economy into recession. The Fed will likely increase rates by 0.5% in May, which would be the first 0.5% rate hike since 2000. We expect further rate increases through the year until it appears that inflation is slowing.

The employment situation has improved dramatically since the onset of the pandemic. The unemployment rate fell to 3.6% in March, compared to 3.5% in February of 2020, before the pandemic. Similarly, the total of 6 million workers unemployed in March was little different from the 5.7 million in February 2020. Wages have also climbed after many years of slow growth. Wages adjusted for inflation (real wages) have declined, however, and demand for workers appears to be cooling. It is critical that inflation rates come down so that workers can maintain their spending to support economic growth.

Consumer spending growth slowed in February, and consumer confidence hit a 10-year low in March. The housing market may provide some clues as we watch for signs of any further decline in spending. Tight housing inventories and rising construction costs have combined with strong demand, particularly from first-time home buyers, to boost home prices. However, mortgage rates surged from 3.2% to 4.9% in early April, the highest level since 2018, and may crimp future demand. Rising costs of energy, due to the Russian invasion of Ukraine, and of other goods and services may lead potential buyers to delay home purchases and other spending. We will be watching these trends closely.

Another potential warning comes from the difference between short-term and long-term interest rates, or the yield curve. Short-term rates recently ticked above long-term rates briefly, a condition known as a yield curve inversion, which can be a harbinger of a recession.

Abroad, the situation in Ukraine will continue to impact the global economy and consumer sentiment, particularly in Europe, where economic growth is slowing due partly to the surge in energy prices resulting from the invasion. Inflation in Europe has quickly risen to multi-decade highs, and governments there are shifting investments to defense.

COVID-19’s ongoing effects will remain another critical factor. New cases are down significantly from the highs in January, but they are ticking back up in some places as the latest variant spreads. Notwithstanding the threat of a resurgence of COVID-19 cases, the U.S. economy will likely continue to expand, and corporate earnings should rise, but increases in both will likely moderate relative to last year given current conditions.

Investment Implications

As for our portfolios, we believe there should be good opportunities for long-term capital appreciation both in the United States and abroad. Stocks tend to do well after exiting a correction, which the S&P 500 index recently did. We favor shares of companies that have strong competitive positions and the ability to increase prices if necessary to maintain profit margins. For income investments, we prefer securities of companies with the potential to increase dividends and favor short-term to intermediate-term bonds over longer-term bonds.

Analysis of Selected Securities

The following is a discussion of three securities we own and have bought recently. Due to factors specific to each company, these stocks are, in our opinion, priced attractively in the markets today.

Berkshire Hathaway Inc. (BRK.B)

Price (3/31/2022): $352.91 Fwd P/E: 26.5

Market Cap ($B): $778.0 Price/Book: 1.5

Dividend Yield: 0.0% Price/Sales: 2.3

Return on Equity: 18.9% Debt/Equity: 0.2

Sources: Morningstar, YCharts

Long-time core holding Berkshire Hathaway operates in a diverse range of industries, including insurance, railroads, utilities, energy, manufacturing, services, and retailing. Chairman and CEO Warren Buffett and Vice Chairman Charles Munger, two of the most successful investors of all time, focus on the company’s capital allocation and investment decisions while managing the operating businesses on a decentralized basis, allowing management autonomy at each subsidiary.

Berkshire’s core insurance segment collects premiums on policies in advance of future claims, resulting in funds to invest. Excellent management of these funds, often referred to as insurance float, has allowed Berkshire to generate strong long-term returns, complementing the earnings from its other operating subsidiaries.

Key to Berkshire’s growth strategy has been its many acquisitions. Buffett’s proclivity to acquire companies with consistent earnings power, above-average returns on capital, and solid management teams has resulted in a robust and diversified revenue and earnings base for the firm. Berkshire has also chosen to invest in equity markets when unable to find attractive acquisition targets, giving rise to a large portfolio of equity holdings with a market value of more than $350 billion as of the end of 2021, up from $281 billion the prior year.

Even after ramping up its share repurchases in late 2020 to distribute cash to shareholders, Berkshire ended 2021 with a record $147 billion in cash and equivalents on hand. In March 2022, Buffett ended his six-year drought of large acquisitions, striking an agreement to buy insurance company Alleghany for $12 billion. Like Berkshire, Alleghany is an insurance-based conglomerate that owns several non-insurance businesses, including companies that focus on industrial parts, machine tools, hotels, and toys. If completed, the acquisition will be one of the five largest in Berkshire’s history and will expand Berkshire’s large portfolio of insurers. Also during the quarter, Buffett purchased a nearly 15% stake in Occidental Petroleum worth $8 billion. The rapid accumulation of Occidental shares has spurred speculation that Berkshire may seek to acquire the company and combine it with Berkshire Hathaway Energy to create one of the largest energy and utility businesses in the United States.

We believe Berkshire should continue to perform well even after Buffett, 91, and Munger, 98, step down from their leadership roles. The company has successors in place, and whoever succeeds Buffett and Munger will inherit a strong balance sheet and diversified earnings stream. It is also likely that the company will initiate dividend payments to shareholders after Buffett retires. In our opinion, Berkshire continues to be attractively priced at a current valuation of 26.5 times forward earnings and 1.5 times book value, consistent with its historical five-year averages, particularly given the prospect of renewed growth from the recent investments made by Buffett during the first quarter of 2022.

Microsoft Corporation (MSFT)

Price (3/31/2022): $308.31 Fwd P/E: 26.3

Market Cap ($T): $2.2 Price/Book: 13.4

Dividend Yield: 0.9% Price/Sales: 11.7

Return on Equity: 49.1% Debt/Equity: 0.4

Sources: Morningstar, YCharts

Microsoft is the world’s largest independent software developer, best known for its Windows operating system and Office applications. As it has grown, Microsoft has also expanded into providing cloud services and producing personal computing devices. The company is organized into three equally sized segments: productivity and business processes, intelligent cloud, and personal computing. Approximately 50% of total revenue is generated outside the United States.

With its software and applications deeply embedded in most business processes and everyday workplaces, Microsoft has been able to grow its market share to approximately 80% for personal computer operating systems. Microsoft’s office productivity software enjoys a large and loyal customer base as well as high switching costs due to Microsoft’s near monopoly position.

Microsoft has been successful in growing its revenues in a constantly evolving technology landscape, with a new focus on moving existing workloads to the cloud for current customers and attracting new clients directly to its cloud services. The ability to seamlessly transition Microsoft’s popular products from on-premises to the cloud will be a critical revenue driver for the company as new hybrid work environments drive mass cloud adoption. Microsoft has doubled its market share to approximately 20% in cloud infrastructure over the last few years, second behind Amazon Web Services.

Microsoft has also recently turned its focus to its videogaming business with an agreement announced in January to acquire videogame publisher Activision Blizzard in an all-cash transaction for $69 billion. Activision Blizzard has some of the videogame industry’s most popular and long-running videogame franchises. If the proposed transaction is successful, Microsoft’s gaming division will become the third-largest gaming company by revenue behind Tencent and Sony. We believe the acquisition of Activision Blizzard makes strategic sense for Microsoft and are encouraged that Microsoft is investing some of its $125 billion in cash and equivalents. We were also pleased to see that Microsoft was able to capitalize on Activision Blizzard’s lower share price with its acquisition offer, as we also viewed Activision Blizzard as undervalued and had previously bought the shares in client portfolios.

Given its large user base and well-known products, we believe that Microsoft is well positioned to grow earnings as it benefits from continued information technology spending and accelerating digital transformations from on-premises to the cloud. We view Microsoft’s current valuation of 26.3 times forward earnings as reasonable when considering its earnings growth outlook and robust free cash flow generation. Microsoft is also focused on returning capital to shareholders in the form of both dividends and share buybacks.

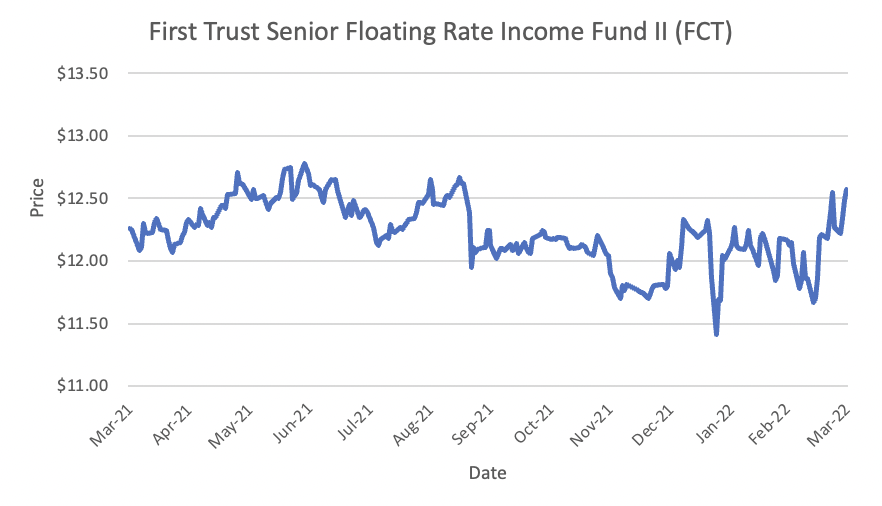

First Trust Senior Floating Rate Income Fund II (FCT)

Price (3/31/2022): $12.57

Net Asset Value (3/31/2022): $12.02

Assets Under Management ($M): $312.1

Annual Expense Ratio: 1.7%

Distribution Rate: 6.9%

Sources: Morningstar, YCharts, First Trust Advisors

First Trust Senior Floating Rate Income Fund II is a closed-end fund that seeks to achieve current income by primarily investing in a portfolio of senior secured corporate loans. These loans generally hold one of the most senior claims on a business’s assets, above those held by subordinated debtholders and stockholders, and are typically secured by specific collateral.

Additionally, most senior loans have floating rates, with their interest rates typically determined either monthly, quarterly, or semi-annually by reference to a base lending rate plus a premium. Since these short-term base lending rates are generally closely correlated to the Federal Reserve’s federal funds rate, senior loans tend to offer some yield protection when the Fed hikes rates.

The senior loan market has recently seen renewed investor interest, experiencing its thirteenth monthly inflow of funds in December. Additionally, total assets under management in senior loan mutual funds increased to $99 billion at year end from $69 billion last year.

We value the First Trust investment team’s active approach to selecting the loans in their portfolio through the use of a bottom-up credit analysis process aimed at identifying the opportunities that they believe offer the best risk reward balance. The fund has experienced zero defaults in the quarter and zero defaults during the last twelve-month period as industry-wide default rates have declined well below their long-term average of 2.8% as the economy recovery progresses. Despite trading at a slight premium to its net asset value, FCT shares still have an attractive distribution rate of 6.9%, which is paid out monthly. With the current outlook for less accommodative policy from the Federal Reserve and an accelerated path for rates hikes likely this year, we believe floating rate senior secured loans are an important asset class to add to our clients’ income portfolios.

Disclosures

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results.

Indices are unmanaged, and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions, or other expenses that would be incurred.

The S&P 500 index is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value-weighted index with each stock’s weight in the index proportionate to its market value.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. Investors frequently use the index as a proxy for measuring the performance of the U.S. bond market.

Exchange-traded funds (ETFs) are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from the fund company or your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

The S&P SmallCap 600 Index is an index of small-capitalization stocks managed by Standard and Poor’s. It tracks a broad range of small-sized companies that meet specific liquidity and stability requirements, determined by specific metrics such as public float, market capitalization, and financial viability, among a few other factors.

The Russell 2000 Index is an unmanaged index that measures the performance of the small-capitalization segment of the U.S. equity universe.

A REIT is a security that sells like a stock on the major exchanges and invests in real estate directly, either through properties or mortgages. REITs receive special tax considerations and typically offer investors high yields, as well as a highly liquid method of investing in real estate. There are risks associated with these types of investments and include but are not limited to the following: potential difficulty discerning between routine interest payments and principal repayment; redemption price of a REIT may be worth more or less than the original price paid; value of the shares in the trust will fluctuate with the portfolio of underlying real estate; and involves risks such as refinancing in the real estate industry, interest rates, availability of mortgage funds, operating expenses, cost of insurance, lease terminations, potential economic and regulatory changes. This is neither an offer to sell nor a solicitation or an offer to buy the securities described herein. The offering is made only by the prospectus.