Homeownership vs. Renting: Navigating the Current Interest Rate Environment

Oct 3, 2023For many Americans, homeownership is a pillar of the American dream and often represents financial success and independence. Choosing to buy or rent is a major decision that impacts your financial health and lifestyle, and there are pros and cons to each option. In today’s higher interest rate environment, this decision is even more complex due to higher borrowing costs and rent increases. Ultimately, it is essential to align this decision with your personal financial goals, since there is no one-size-fits-all approach.

Homeownership Considerations

Mortgage Affordability and Market Conditions:

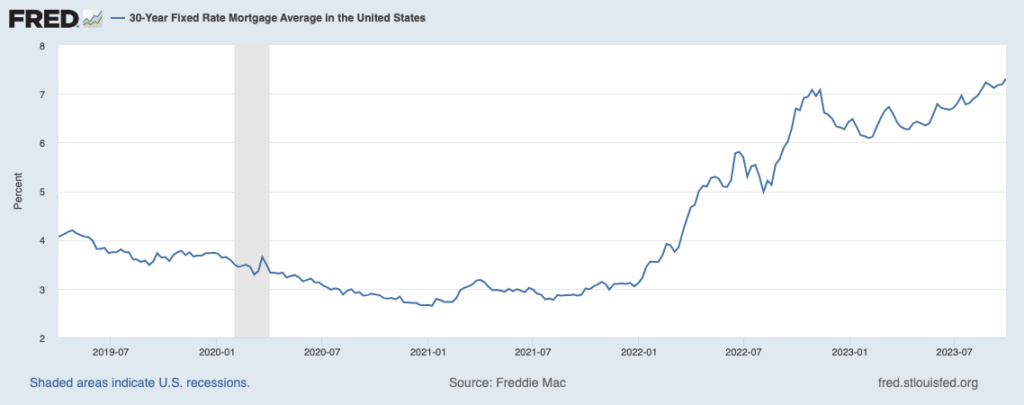

- Interest rates play a key role in the overall cost of homeownership. As rates have climbed to multi-year highs, so has the cost of borrowing.

- High-interest rates can make homeownership less affordable for many prospective buyers, especially first-time home buyers.

- For example, a $500,000 home purchase with a 30-year fixed mortgage, a 20% down payment, and 3% interest rate results in a monthly principal and interest payment of $1,686.42.

- The same purchase at a 7% interest results in a monthly principal and interest payment of $2,661. Over the life of the mortgage, this is an added cost of $350,926.

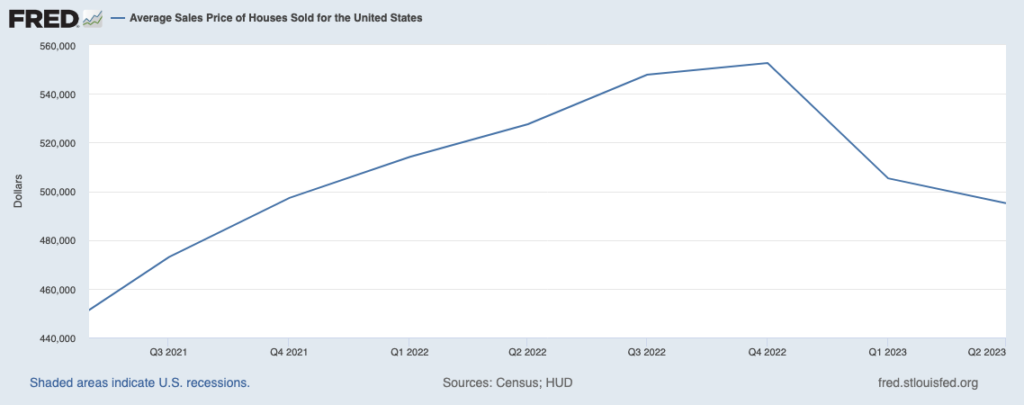

- Additionally, home prices in the U.S. increased significantly since the Covid-19 pandemic, although they declined slightly in the first half of 2023. According to the Federal Reserve Bank of St. Louis, the average sale price of homes in the past two years has jumped from $440,600 to $495,100, an increase of 12%.

- In determining the overall cost of homeownership, one must also consider the cost of property maintenance, repairs, and property taxes

Home Appreciation and Equity:

- One of the primary benefits of homeownership is building equity in your property. While the current interest rate environment and housing market is more expensive, real estate has historically been a reliable long-term investment.

- From 1970 – 2022, housing price increases have outpaced inflation by 150%.

Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends. The Consumer Price Index (CPI) is a measure of inflation compiled by the US Bureau of Labor Studies. Consumer Price Index for All Urban Consumers (CPI-U): U. S. city average, by detailed expenditure category including food, energy, appliances, apparel, transportation, shelter, recreation, medical, education, etc.

- Even in a high-interest rate environment, homeowners can build equity as they pay down their mortgage.

- When identifying your future home and potential for future growth, some factors include location, accessibility, school district, safety, amenities, and historical trends for the neighborhood.

Tax Benefits of Homeownership:

- Mortgage interest deduction

- One of the most significant tax benefits of homeownership is the ability to deduct the interest paid on your mortgage.

- The deduction is limited to interest on up to $750,000 of qualified mortgage debt.

- Property tax deduction

- You can also deduct the property taxes you pay on your primary residence from your taxable income. These deductions vary based on location and the assessed value of your home.

- Capital gains exclusion

- When you sell your primary residence, you may qualify for a capital gains exclusion. A single filer may exclude up to $250,000 in capital gains, and a married couple filing jointly may exclude up to $500,000. The seller must have owned the home and used it as their primary residence for two out of the last five years.

Renting Considerations

Affordability

- Lower initial costs

- Renting typically requires a much lower upfront financial commitment than buying a home. Typically, the first month’s rent is required as a security deposit and is far less than a mortgage down payment with closing costs.

- No property maintenance

- Renters are not responsible for property maintenance and repairs. If something breaks, it is typically the landlord’s responsibility.

- Minimal market risk

- Renters have no equity in the property and therefore are not exposed to the fluctuations in the real estate market.

- Property taxes and insurance

- The landlord is responsible for paying property taxes and homeowner’s insurance. Renter’s insurance is typically less expensive than homeowner’s insurance and covers personal belongings and liability but excludes the structure.

Lack of Control

- Rules and restrictions

- A renter has limited control over the property and must agree to the landlord’s rules in the rental agreement, including restrictions on home modifications or decorations.

- Rent increases

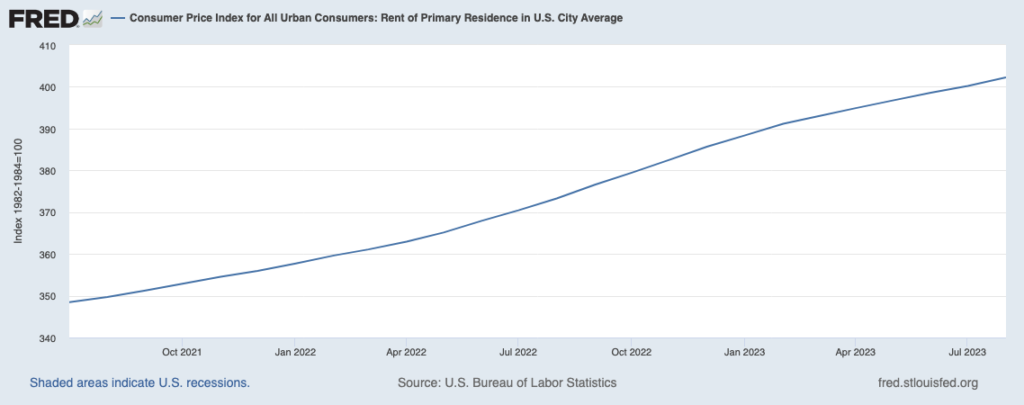

- Rental agreements are for a limited term, so once the lease expires, a landlord may increase the cost of rent. In the current high-interest rate environment, rents have increased significantly.

- No tax benefits

- Renters do not benefit from the various tax deductions associated with homeownership, such as the mortgage interest deduction and property tax deduction.

Flexibility

- Mobility

- Renting provides more flexibility in terms of where you decide to live. If you experience a job change or a major life event, it is much simpler to end a lease and relocate.

- Leases typically have a relatively short duration of 6-12 months, which allows renters to move more frequently without the burden of selling a property.

- Amenities

- Many rental properties, especially apartment complexes or condominiums, offer amenities such as gyms, offices, and pools.

- Investment in other areas

- While renters do not build equity in the property, the lower upfront cost may allow for increased savings in investment or retirement accounts.

The decision to buy a home or continue renting is one of the most significant financial decisions many Americans face. In today’s higher interest rate environment, the choice becomes more complex, and it is critical to weigh the costs and benefits of both homeownership and renting. Ultimately, the answer depends on one’s personal goals, financial situation, and lifestyle preferences.

At Glassy Mountain Advisors, we are here to help guide and educate you on your unique goals. Please contact Matt Altman (maltman@glassymountainadvisors.com) to discuss buying vs. renting, or other financial planning topics.

This blog contains general information that may not be suitable for everyone. The information contained herein should not be construed as personalized investment advice. Past performance is no guarantee of future results. There is no guarantee that the views and opinions expressed in this blog will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.