Quarterly View: April 2025

Apr 10, 2025Listen to an abbreviated version of the commentary below here:

- Stocks declined to start the year, with the S&P 500 falling 4.3% in the first quarter, including dividends.

- Investors fled higher-risk stocks in the technology, communications, and consumer discretionary sectors, which sustained significant losses for the quarter, while market leadership appeared to rotate toward more defensive and value-oriented sectors such as energy, healthcare, and consumer staples. Bonds offered another safe haven for investors, with the Bloomberg U.S. Aggregate Bond Index increasing 2.8% in the first quarter.

- During the early weeks of April, uncertainty from the Trump administration, especially around trade policy and tariffs, contributed to a rise in market volatility as investors tried to keep up with the latest tariff announcements and their likely impact on inflation and economic growth.

- The Federal Reserve held interest rates steady at their two meetings during the quarter, and central bankers expressed the need for a wait-and-see approach toward future rate cuts to assess the potential impacts of tariffs on inflation and economic growth.

- We are taking a cautious approach to the investment markets in the near term and expect volatility to continue as investors ascertain the effects of President Trump’s policy initiatives on the business and economic climate.

Stocks tumble as Trump 2.0 begins

Stocks rolled into 2025 on a wave of optimism, buoyed by reports of resilient economic growth from the previous quarter and expectations of more business-friendly policies from the incoming Trump administration. This optimism lifted stocks early in the first quarter, including a series of new all-time highs for the S&P 500 into February. But as policy initiatives from the Trump White House began to take shape—especially around higher tariffs on imports from established trade partners including Canada, Mexico, and China—market volatility increased and stocks tumbled into a correction (defined as a loss of 10% or more from a market peak). Fearful investors fled higher-risk stocks in the technology, communications, and consumer discretionary sectors to seek lower volatility in U.S. Treasuries and defensive sectors of the stock market.

Our outlook for stocks has shifted to a more cautious view as we monitor how businesses adapt to these sweeping policy changes and await hard data from company earnings and economic reports to arrive in April and May. We anticipate markets will remain volatile in the near term and expect uncertainty in the political sphere will likely continue, given President Trump’s predilection for hardball negotiating and dealmaking tactics. Tariffs may contribute to a return of higher inflation and potentially slower economic growth, placing the Federal Reserve in a bind between wanting to ease interest rates to avoid recession and needing to tighten rates to tame inflation.

First Quarter Review

The S&P 500 fell 4.3% in the first quarter of 2025, marking the worst quarter for stocks in over two years. Stocks briefly rallied into the new year with the benchmark equity market index continuing to make all-time highs up until February 19. Through this time, investors anticipated the return of business-friendly policies from the incoming Trump administration and remained optimistic even though announcements of government spending cuts, federal workforce reductions, and tariffs raised the possibility of higher inflation, rising unemployment, and slowing economic growth.

Eventually, uncertainty over the evolving tariff policy was too much for the markets to bear, and stocks fell into a correction, with the S&P 500 dropping over 10% from its last peak. It was the fastest stock market correction since the onset of the COVID-19 pandemic. As the quarter ended, signals from administration officials of a more flexible approach to tariffs helped halt the decline, but fear persisted as President Trump’s April 2nd Liberation Day announcement loomed.

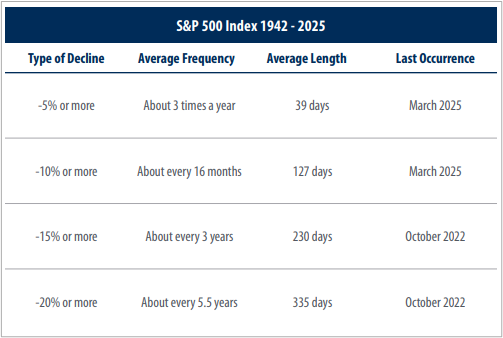

Source: First Trust, Bloomberg (data from 4/29/1942 – 3/31/2025)

After such a dramatic drop in the markets, it helps to step back and take measure of where things stand. To start, stock investors have enjoyed two-plus years of solid gains, so a pullback, even a significant one, would not be unexpected. Moreover, downturns and corrections are a normal part of investing in the stock market. The S&P 500 has experienced drops of 5% or more in 93% of calendar years and drops of 10% or more in 47% of calendar years since 1980. Whether from a correction or a bear market, the U.S. stock market has always recovered in due course, sometimes very quickly. Although short-term market movements can be unpredictable, we believe a disciplined approach to investing in stocks leads to reliably positive returns over the long term.

Big one-day drops in the stock market tend to make headlines, but to grasp what is really going on in the broader market it is important to look past the index numbers. For example, just three of the 11 sectors in the S&P 500 drove nearly all of the index’s loss in the first quarter. These three sectors—technology, communications, and consumer discretionary—fell sharply while seven other sectors actually posted gains for the period. Specifically, losses among the so-called Magnificent 7 stocks, which had powered the majority of the S&P 500’s rise over the last two years, had the opposite effect in the first quarter by weighing down overall returns. In the case of these stocks, doubts over the prospects for their AI buildouts hit share prices after news broke about DeepSeek, a cheaper and faster AI model developed in China.

Source: YCharts

The shift in momentum we saw in the first quarter was a classic flight to quality, in which fearful investors fled higher-risk areas of the market for relatively safer investments. This shift included the traditional value sectors such as energy, health care, and consumer staples, which outpaced all other S&P 500 sectors during the quarter, and dividend-paying stocks in the utilities, real estate, and financial sectors, which posted gains as well. We also witnessed rotation from U.S. stocks to international markets (measured by the MSCI All Country World Index ex-USA), which were broadly positive in the first quarter, as investors saw more attractive opportunities in undervalued foreign stocks. However, it was not all positive news outside of the S&P 500; small-company stocks (measured by the S&P 600 Index) fared worse than large stocks during the quarter and declined over growing fears of a slowdown in business activity.

Source: YCharts

Investors also sought to lower risk by moving to the safety of U.S. Treasuries, sending the benchmark 10-year Treasury yield lower during the first quarter. This cautious mood was seen in other parts of the bond market as well, with both investment grade and high yield corporate bonds underperforming U.S. Treasuries during the quarter as investors avoided taking higher credit risk.

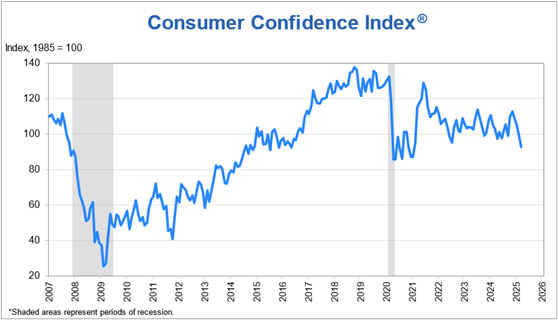

The mood about the economy may have turned gloomy, but the actual numbers reported in the first quarter continued to tell a story of resilience. Growth in gross domestic product for the fourth quarter came in weaker than the previous quarter but a still-respectable 2.4% year-over-year rate. The job market also softened during the first quarter, but growth in nonfarm payrolls was still solid and the unemployment rate held steady in the low-4% range. Concerns over employment were rising, however, following announcements of layoffs in the federal government workforce and spending cuts that affect firms doing business with the U.S. government. These concerns showed up in consumer confidence readings in March, which slipped to levels not seen in several years and added to the unease in the financial markets.

Source: The Conference Board, NBER

Recent consumer surveys from the University of Michigan also showed a spike in expected inflation over the next 12 months, reaching levels that harken back to the post-pandemic inflationary surge of 2022. These expectations were a break from the trend in actual reported inflation, which has remained under control in recent months. All the work done by the Federal Reserve to manage interest rate policy over the last several years has helped ease pricing pressures and keep the U.S. economy out of recession. Yet, inflation rates are still not at the Fed’s target level. After three cuts in 2024, the Fed held interest rates steady throughout the first quarter as its preferred inflation gauge remained elevated. The path forward for the Fed is also clouded by uncertainty over the implementation of Trump’s tariff policy. In March, Federal Reserve chair Jerome Powell acknowledged the potential for higher tariffs to have a transitory effect on inflation, necessitating a wait and see approach to future interest rate actions until any impact shows up in the economic data.

Outlook

As the second quarter began, U.S. stock markets convulsed following President Trump’s April 2nd Liberation Day announcement of widespread tariff increases for nearly all trading partners. News of the higher tariff rates on imports from specific countries such as China, India, Vietnam, and the European Union was worse than what investors had expected and increased the level of uncertainty and volatility in the financial markets. Most of the concern focuses on the impacts on future economic growth. Even prior to the President’s April 2nd announcement on tariffs, projections for the first-quarter GDP growth rate, according to the Atlanta Fed’s GDPNow model, had fallen from around +2% at the end of February to around -2% at the end of March. Widespread anxiety about prospects for the jobs market, with mass layoffs and spending cuts across the federal government likely to push the unemployment rate higher, also weighed on investors. Because employment and consumer spending are closely linked, and because consumer spending accounts for a significant share of U.S. economic activity, it is easy to envision a bleaker picture for the months ahead if tariffs lead to a pullback in consumer spending and the jobs market weakens further.

At this moment, it is hard to discern where markets go from here. President Trump’s announcement of a 90-day pause for countries set to be hit with tariffs above 10% sparked a historic rally for U.S. stocks – the S&P 500 index jumped 9.5% on April 9th, marking its best one-day gain since October 2008. However, uncertainty remained as Trump’s sudden reversal did not provide further clarity on his administration’s trade policy and, despite the historic one-day rally, the S&P 500 closed around 4% lower than where it was before the tariffs were announced.

Given the recent uncertainty and volatility in the stock market, we believe the prudent approach is to focus on the fundamentals of investing. Economic growth and company earnings are the two biggest factors that drive stock performance. Both are likely to feel pressure from tariffs, but much will depend on how different tariff policies evolve through negotiations. If or when specific tariffs are implemented, it will take several months for the actual impact to show up in data. Moreover, tariffs are likely to affect different industries and even different companies in different ways. Some will suffer, many will have to adapt, and others may be less affected than originally feared. As we await future reports, we will keep watch on the markets, the economy, and the political world to help us assess how to position our portfolios for opportunities to come.

We have learned from past downturns that turbulence can be scary in real time, but the market has made it through these bumps and continued to grow over the long run. The best approach to managing emotions during these times is to remain calm and stay disciplined with your investment plan. We are not saying we should ignore what is going on—we are paying close attention to the factors driving the markets so we can understand the impact on the economy, businesses, and our portfolio holdings. While the recent market fluctuations can be unsettling, remember that we manage investments to withstand periods of volatility and achieve our clients’ goals over the long term. Also remember you are not alone in feeling anxious about investment losses. It is natural to do so, but we do not have to let emotion control our investment decisions.

In summary, we are cautious about prospects in the stock market for the months ahead, though more optimistic for the long term. Initiatives to reduce regulation and lower taxes are bound to be good for corporate profits and investment returns, but all the uncertainties around the economic impacts of tariffs and government layoffs are obstacles to success. There is potential for new leaders to emerge amid the turbulence in the stock market and for downturns such as these to provide potential buying opportunities. Market volatility will certainly test this belief, but the outcome will reward investors who remain patient, disciplined, and diversified over the long term.

Disclosures

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results.

Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

The Standard & Poor’s 500 (S&P 500) Index is a free-float weighted index that tracks the 500 most widely held stocks on the NYSE or NASDAQ and is representative of the stock market in general. It is a market value weighted index with each stock’s weight in the index proportionate to its market value.

The Standard & Poor’s 500 Total Return Index (SPTR) is an unmanaged group of securities considered to be representative of the stock market that tracks capital appreciation as well as distributions. It is a market value weighted index with each stock’s weight in the index proportionate to its market value. The Total Return index assumes that all cash distributions (dividends and/or interest) are reinvested.

The Bloomberg Barclays US Aggregate Bond Index, or the Agg, is a broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. Investors frequently use the index as a stand-in for measuring the performance of the US bond market.

The MSCI ACWI ex USA Investable Market Index (IMI) includes large, mid and small cap companies and targets coverage of approximately 99% of the global equity opportunity set outside the US. The MSCI ACWI ex USA Index captures large and mid cap representation across 22 of 23 Developed Markets (DM) countries (excluding the United States) and 24 Emerging Markets (EM) countries. The index targets coverage of approximately 85% of the global equity opportunity set outside the US.

The S&P 600 Total Return Index is an index of small-cap stocks managed by Standard and Poor’s. It tracks a broad range of small-sized companies that meet specific liquidity and stability requirements. This is determined by specific metrics such as public float, market capitalization, and financial viability, among a few other factors.

The U.S. consumer confidence index (CCI) is an economic indicator published by The Conference Board to measure consumer confidence, which is defined by The Conference Board as the degree of optimism on the state of the U.S. economy that consumers are expressing through their activities of savings and spending. Global consumer confidence is not measured.