Quarterly View: December 2024

Jan 9, 2025Listen to an abbreviated version of the commentary below here:

- Stocks rose modestly in the fourth quarter with the S&P 500 gaining 2.4%, including dividends, and returned 25.0% for the calendar year.

- Growth-oriented stocks in the technology, communications, and consumer discretionary sectors resumed their leadership during the quarter and widened the performance gap with the rest of the market.

- Equities received a boost from the resolution of the U.S. presidential election as investors forecasted more business-friendly policies from the incoming Trump administration and Republican Congress.

- The Federal Reserve lowered interest rates by a quarter-point in November and again in December, but the final meeting of the year came with projections of fewer rate cuts in 2025, sapping momentum from both stocks and bonds.

- We are optimistic about investment opportunities and economic conditions in the year ahead, but we are cautious about lofty stock market valuations and the uncertainty around potential policy changes from Trump’s incoming administration.

Stocks soar in a stellar year for investors.

Stocks closed out a remarkable year with a modest gain in the fourth quarter, powered by resilient economic growth and continued strength in corporate earnings. Both factors have helped sustain the ongoing bull market, which entered its third year during the past quarter. Stocks in the technology, communications, and consumer discretionary sectors contributed significantly to quarterly returns, reinforcing the split between these growth-oriented stocks and the rest of the market. Additionally, the outcome of the U.S. presidential election removed a significant amount of uncertainty from the market, although investors must now reckon with questions over what policies the incoming Trump administration will put in place and how they may impact the economy and business conditions.

Our outlook for stocks in the year ahead is generally positive. The U.S. economic expansion is poised to continue in the coming quarters, and consumer spending should hold up given strong labor markets, easing price pressures, and lower interest rates. Companies should also benefit from lower borrowing costs as the Federal Reserve continues to relax monetary policy, even if the pace of rate cuts is slower than previously anticipated. Stock investors have enjoyed a mostly placid ride to record highs through the current bull market, but the potential for volatility in the coming year requires caution. In addition to the uncertain impacts of economic policy changes, there are also concerns about stock market valuations, which have risen to high levels and may temper future returns.

Fourth Quarter Review

The S&P 500 gained 2.4% in the fourth quarter of 2024, closing an overall strong year for the stock market with a 25.0% return for the benchmark index. It was the second straight calendar year when the S&P 500 gained more than 20%–an uncommon feat that last occurred in 1997-98. Investors remained enthralled by anything related to artificial intelligence (AI), with the biggest AI names NVIDIA, Alphabet, and Amazon enjoying most of the attention and contributing significantly to the market’s returns for the quarter. The enthusiasm for AI spread to other companies, too, including chip-maker Broadcom. Meanwhile, all other S&P 500 sectors (save financials) slumped over the three-month period.

Two major events during the fourth quarter helped shape stock market performance for the period. The first was the presidential election; stocks appeared to stall in the weeks leading up to Election Day as uncertainty over the outcome gripped investors, but once the results came out decisively in Donald Trump’s favor the market emerged from its funk. Not only did both large- and small-company stocks rally right after Election Day, riskier assets such as bitcoin and other cryptocurrencies soared as well. Trump’s electoral victory and the Republican sweep of the House and Senate brightened investor prospects for more pro-business policies from the next administration, including lower taxes and greater deregulation.

Later in the quarter, the second event sapped the momentum from the market, following the December meeting of the Federal Reserve’s rate-setting committee. The central bank cut rates by a quarter-point on December 18, as had been largely expected, but more impactful for the markets was the post-meeting statement by Fed Chair Jerome Powell that effectively lowered expectations for future rate cuts in the coming year. The primary impetus for the slower pace of monetary policy easing was persistent inflation; November’s Consumer Price Index numbers showed upticks in both core and headline inflation, casting doubt on the progress the Fed had made in getting consumer price growth under control. Through the final weeks of the year, the market struggled to recover and ended down for the month of December.

Source: YCharts

Over the entire quarter, there was a stark contrast between the headline performance of the S&P 500 (which is weighted by market capitalization, with the largest stocks having greater influence over index returns) and the equal-weighted version of the S&P 500 (with size not factoring into the performance calculation). The equal-weighted S&P 500 declined nearly 2% in the fourth quarter and for all of 2024 lagged the cap-weighted index by nearly half. The strong performance of the biggest large-cap stocks also widened the divide with other equity asset classes. For example, small-company stocks, as measured by the S&P 600 Index, were generally flat for the quarter and recorded a gain of 8.7% for the year. Performance for international stocks continued to lag U.S. equities; the MSCI All Country World Index (ACWI) ex-USA declined almost 8% in the fourth quarter and managed just a 5.2% gain for all of 2024.

While the performance split within equities is notable, there are good reasons for the optimism around U.S. stocks in general and the high-flying technology sector in particular. To start, the U.S. economy is in solid shape. The final estimate for third-quarter real gross domestic product (GDP) growth, released at the end of December, was revised higher to an annualized rate of 3.1%, the strongest pace of growth in 2024 to date. This pace of growth is expected to continue into the fourth quarter, with real GDP growth of 2.7% year-over-year based on the latest GDPNow forecast from the Atlanta Fed.

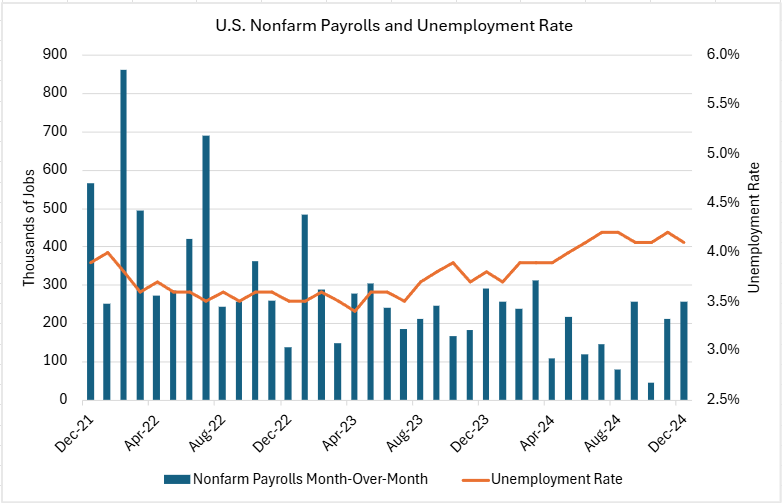

Source: YCharts and Bureau of Labor Statistics

On top of that, conditions in the labor market remained favorable for workers, with 256,000 new jobs added to payrolls in December and the unemployment rate holding steady at around 4%. Average hourly earnings also increased by 4% over the past 12 months, helping brighten the mood of consumers heading into the holiday shopping season. Between November 1 and December 24, consumers spent 3.8% more this year than over the same period last year, according to Mastercard SpendingPulse data.

The continuing U.S. economic expansion has helped companies deliver solid earnings in recent quarterly reports. FactSet reported third-quarter earnings growth for S&P 500 firms increased almost 6% year-over-year, and three-quarters of S&P 500 firms beat analysts’ earnings estimates, equal to the ten-year average. Earnings growth for companies in technology and communications in the third quarter exceeded the market overall, supporting investor optimism for stocks in these sectors. Earnings growth is expected to accelerate in the fourth quarter, a traditionally strong quarter for companies, resulting in full-year earnings growth of 9.5% for 2024.

Source: YCharts

While the strong U.S. economy propelled stocks to record highs, continued uncertainty over the path of future monetary policy and the Fed’s fight against inflation has dampened bond returns. The 10-year U.S. Treasury rate, the benchmark for long-term bonds, ended the year above 4.5%, more than half a percentage point higher than where it started. The Bloomberg U.S. Aggregate Bond Index returned 1.3% for 2024, after a decline of 3% during the fourth quarter wiped out most of the gains for the year.

Outlook

The stock market delivered strong returns over the last two years, but there are several factors that could lead to more moderate gains for stocks this coming year. The first is history; only once in the last 75 years has the S&P 500 managed three consecutive years of gains greater than 20%, making the likelihood for a market “three-peat” small.

Another major factor for stocks in the year ahead will be valuations. The market’s impressive performance as of late has also meant traditional valuation measures have risen. For example, the current price-to-forward-earnings ratio of 21 for the S&P 500 is above its 10-year historical average of 18, and stocks in the higher-growth technology and communications sectors on aggregate now trade at a price-to-forward-earnings ratio closer to 30. However, these lofty valuations can be justified somewhat by the actual earnings companies are delivering to investors. If profits continue to flow, higher stock market valuations can be supported by the continued growth in earnings in the coming year. According to FactSet, analysts are projecting full-year earnings to increase close to 15% for 2025. However, with little room for disappointment, it would not be surprising to see a rise in volatility if investors face any doubts over their expectations for growth in the year ahead.

Finally, we cannot ignore the change in political leadership coming in January. At the start of the new political term, we do not know the details about any new policies that the Trump administration may propose, or how successful the Republican Congress will be in enacting them into law. At this point, we can only speculate about the impacts these proposals may have on the economy and businesses. While Trump is largely seen by investors as business friendly, the complex reality of the U.S. economy may mean any major policy changes could have unintended consequences. For instance, raising tariffs may lead to higher inflation, something that candidate Trump vowed to fight during his presidential campaign.

In summary, we are optimistic about the prospects for stock returns in the coming year, but remain cautious about the potential for volatility in a lofty market and watchful of policy proposals from Trump’s incoming administration. We are also optimistic about bond returns in the year ahead as the Fed’s progress on taming inflation becomes clearer, but we continue to favor a more balanced approach of owning both bonds and higher-yielding equity securities for income-oriented portfolios. No matter what market environment we are in, we believe investors are best prepared for future outcomes with a diversified portfolio and a financial plan that is centered on investment goals.

Disclosures

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results.

Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

The Standard & Poor’s 500 (S&P 500) Index is a free-float weighted index that tracks the 500 most widely held stocks on the NYSE or NASDAQ and is representative of the stock market in general. It is a market value weighted index with each stock’s weight in the index proportionate to its market value.

The Standard & Poor’s 500 Total Return Index (SPTR) is an unmanaged group of securities considered to be representative of the stock market that tracks capital appreciation as well as distributions. It is a market value weighted index with each stock’s weight in the index proportionate to its market value. The Total Return index assumes that all cash distributions (dividends and/or interest) are reinvested.

The S&P 500 Equal Weight Index provides exposure to the largest 500 public U.S. companies in the S&P 500 Index (a market value weighted index). However, each company is weighted at 0.2%, to provide more diversification and less concentration.

The S&P SmallCap 600 seeks to measure the small-cap segment of the U.S. equity market. The index is designed to track companies that meet specific inclusion criteria to ensure that they are liquid and financially viable.

The Nasdaq Composite Index is a market-capitalization weighted index of the more than 3,000 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks. The index includes all Nasdaq listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debentures.

The Consumer Price Index (CPI) is a measure of inflation compiled by the US Bureau of Labor Studies.

The MSCI ACWI Index is a free float‐adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 46 country indexes comprising 23 developed and 23 emerging market country indexes.

The Bloomberg Barclays US Aggregate Bond Index, or the Agg, is a broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. Investors frequently use the index as a stand-in for measuring the performance of the US bond market.