Quarterly View: October 2023

Oct 10, 2023- The U.S. economy displayed signs of health and growth in the third quarter, with GDP on the rise and strong employment figures, but the looming threat of higher interest rates and inflation dampened optimism in the short term for investors.

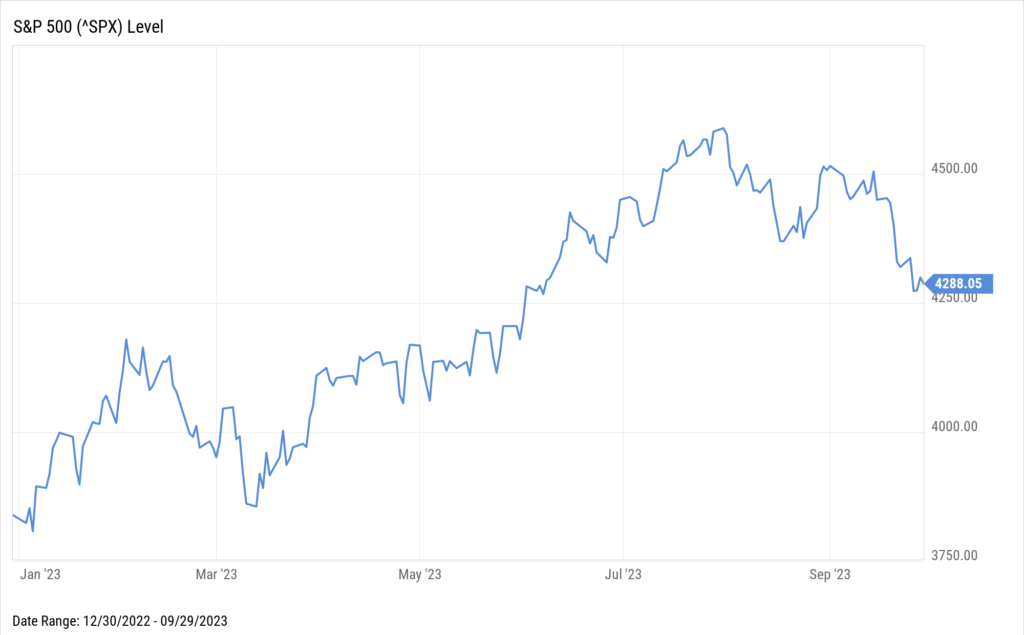

- Stock prices fell; the S&P 500 index returned -3.3%, including dividends, during the quarter.

- Bond yields surged, reaching their highest levels since 2007, as investors anticipated prolonged high interest rates in the face of persistent inflation and a robust economy.

- Despite ongoing concerns about inflation and political turmoil, consumer spending remained strong, particularly in the travel and experiences sectors, signaling resilience in the economy.

- We expect ongoing modest economic growth in the United States for the foreseeable future and are optimistic that stocks will avoid a sharp pullback, though they may not trade much higher than current levels in the near term.

All Eyes on Bonds

The third quarter brought more of the same: another rate hike from the U.S. Federal Reserve and more mixed news on inflation and the economy. Yet the market responded differently this time, falling from its highs as September lived up to its reputation as the worst month for stocks. Despite the recent decline, stocks remain solidly up for the year.

Rising interest rates are top of mind for investors, who have grown increasingly concerned about the possibility that rates will stay high for longer than expected, diminishing the appeal of stocks and threatening the economy. We are optimistic that the markets will persevere through the coming months of political turmoil, economic uncertainty, and likely additional moves by the Fed to tame inflation without a significant downturn, but the path may remain rocky for the time being.

Third Quarter Review

After climbing steadily since October 2022, stocks pulled back in August and September, resulting in a decline of 3.3% for the S&P 500 index, including dividends, for the third quarter. After this drop, the index ended September up 13.1% for the year, still above the long-term average for stock market returns.

Source: YCharts

The primary factors leading to the S&P 500 index’s decline in the third quarter included ongoing high inflation, strong employment that could keep inflation elevated, and new concerns regarding the economy’s ability to withstand higher interest rates. Political squabbling, including the potential for another government shutdown and the ouster of the House Speaker, added to investors’ angst.

Annual inflation remained above the Fed’s target, but there were signs of improvement. The Fed’s preferred measure of inflation, the core personal consumption expenditures price index (PCE), declined from an annual rate of 4.3% in July to 3.9% in August. The same measure rose only 2.2% over the past three months. This reading was close to the Fed’s target and indicated the likelihood of a further decline in the annual rate in the months ahead.

Bond yields rose, largely due to investors’ expectations that the Fed would leave interest rates higher for longer in the face of a strong economy and persistent inflation. The yield on the 10-Year Treasury surged from 3.8% to 4.6% during the quarter and reached 4.8% shortly after, the highest since 2007.

Despite ongoing high inflation, U.S. consumer spending remained remarkably strong, as people traveled and splurged on experiences after previously directing their money toward goods and home improvements during the pandemic. Travel abroad was particularly robust, with tourists flocking to Europe and other destinations despite heavy crowds and hot weather. Partly due to this spending, corporate earnings for the second quarter came in better than expected, but earnings still dropped 4%.

Outside the United States, China was in the spotlight, as trouble in the overbuilt real estate market has led to economic uncertainty there. Chinese stocks held steady for the quarter, but concerns linger. The European Central Bank will likely continue increasing interest rates to fight against inflation, currently running at about 6%. Europe’s largest economy, Germany, is expected to shrink this year due to higher-than-expected energy prices as a result of the war in Ukraine. For the quarter, developed markets including Europe returned -4.7% but are still up 6.3% for the year, including dividends.

Outlook

We expect ongoing modest economic growth in the United States for the foreseeable future and are optimistic that stocks will avoid a sharp pullback, though they may remain around current levels in the coming months. Most signs point to a U.S. economy that is healthy and growing. Gross domestic product (GDP) rose 2.1% in the second quarter of 2023 and likely climbed at a higher rate in the third quarter. Recession fears have eased; more economists now expect only a slight slowing of economic growth.

Offsetting these positive signs is the potential for higher interest rates to curb spending by consumers and businesses, a concern that has been rising in recent weeks as interest rates surged. The resumption of student loan payments and prospects for a slowing economy could also cause consumer spending to slow.

One of the biggest factors impacting the markets is employment. Demand for workers remains robust: jobs in the United States surged 336,000 in September, significantly higher than analysts had forecast, and the unemployment rate was unchanged at 3.8%. The Fed wants to see further cooling in job growth, which should lead to reduced pressure on wages and lower inflation, before ending its rate-hike cycle and considering any rate cuts.

High interest rates and inflation have led home sales to decline while both buyers and sellers wait for improved market conditions. Existing homeowners are wary of trading their low-rate mortgages for the higher-rate ones necessary to acquire new homes. Meanwhile, buyers are facing increased mortgage costs, limiting their ability to pay, while the limited inventory has kept the prices of available homes high. A reduction in interest rates would likely boost home sales.

We expect corporate earnings to increase slightly for the third quarter, and analysts are currently forecasting a larger increase of about 8% in the fourth quarter. The S&P 500 index currently trades at just under 18 times estimated earnings for the next twelve months, a decline from a multiple of about 19 times at the end of the second quarter. This current price/earnings ratio is below the five-year average of 18.7 but above the ten-year average of 17.5. We believe shares of high-quality companies with healthy balance sheets and cash flow generating capacity should perform well over the coming years from this starting point, even if investors remain cautious in the near term.

Further Analysis of Stock and Bond Markets

The following is a discussion of the best and worst performing sectors in the S&P 500 index through September, an overview of the bond market, and an update on one of our stock holdings, Splunk.

Source: YCharts

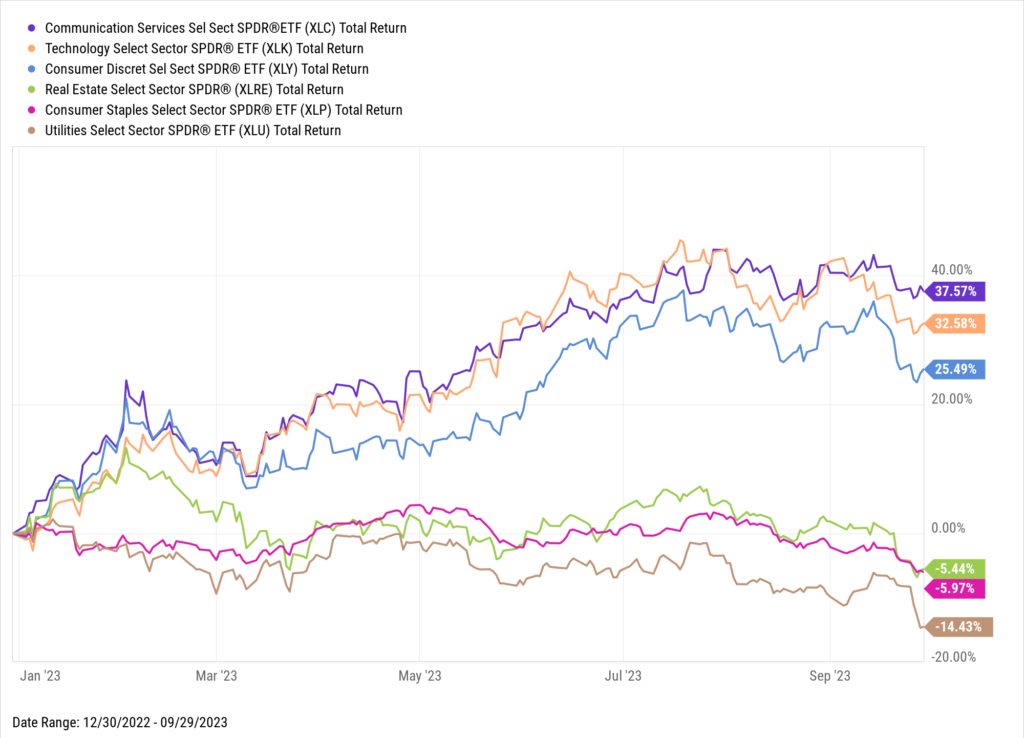

The top three performing sectors in the S&P 500 through the first three quarters of 2023 were communication services, technology, and consumer cyclicals, all of which contain a higher proportion of growth stocks. Technology stocks rallied on investor optimism for artificial intelligence and expectations for its broad adoption across multiple industries.

Meanwhile, the bottom three performing sectors in the S&P 500 so far this year were utilities, consumer staples, and real estate as investors rotated out of these more defensive sectors in favor of growth. Investors typically buy stocks in these three sectors partly due to their higher yields, since they pay out more of their earnings as dividends. Recently, however, higher bonds yields have made these stocks less attractive to investors.

Another notable sector in the red during 2023 was healthcare, which was the fourth worst performing sector in the S&P 500 during the year. After COVID-19 testing and treatment fueled growth through much of the pandemic, many healthcare stocks are now facing tough comparisons to prior year results as earnings continue to moderate with waning COVID-19 cases.

Source: YCharts

High yield bonds represented one of the best performing segments of the bond market during 2023. The higher yield from these bonds comes with higher credit risks; fortunately, given the resilient economy, companies have been able to continue making interest payments, rewarding investors who took on the extra risk.

Meanwhile, U.S. Treasurys, which are backed by the government and thus carry lower risks, are heavily influenced by the Fed’s interest rate policy. With the Fed reiterating its intention to fight inflation through restrictive monetary policy, longer-term Treasurys sold off as investors reassessed the future path of interest rates. Shorter dated Treasury bills (maturing in less than one year) continued to hold up well as investors received higher interest payments with minimal underlying bond price changes. Short-term rates remain higher than long-term, a condition known as a yield curve inversion that has often, but not always, predicted recessions in the past.

Security Highlight

Source: YCharts

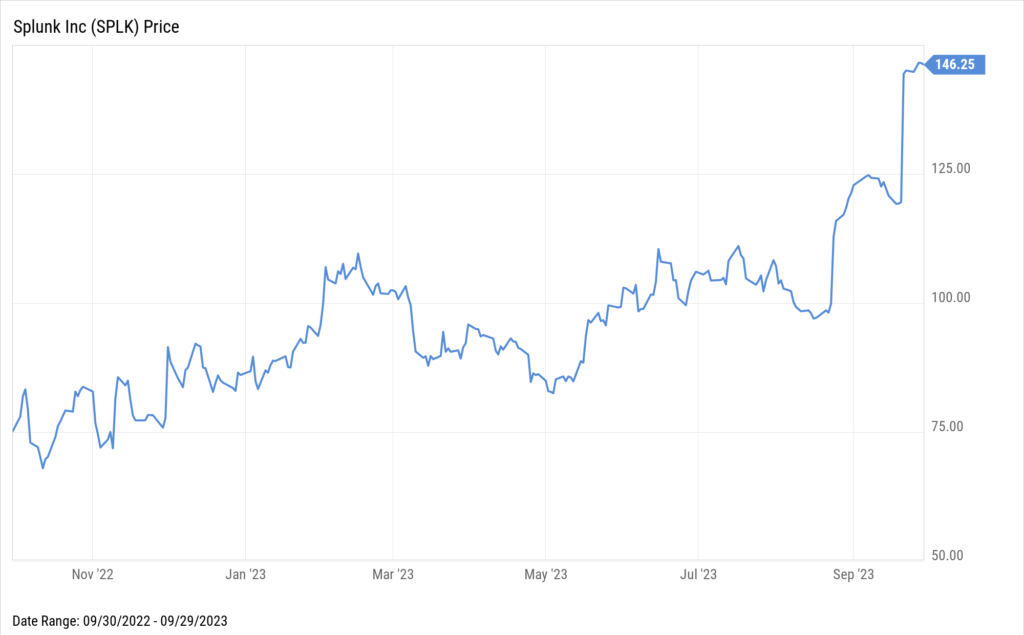

On September 21st, Cisco announced plans to acquire Splunk for $157 per share in cash, representing a 31% premium to Splunk’s previous closing price. Shares of Splunk, a software company focused on analyzing machine data primarily for cybersecurity and IT monitoring, trailed the S&P 500 index during 2021 and 2022 as the company struggled to maintain profitability and increase cash flows. The surprise dismissal of the CEO in November 2021 added to the anxiety and uncertainty for investors. After the new CEO joined in April 2022 and renewed the company’s focus on durable growth, cash flow, and increased profitability, Splunk shares staged a rebound in 2023.

In its most recent quarterly earnings release, management raised its full year outlook for both revenue and earnings as Splunk unveiled new AI-powered offerings and saw high demand for its products while continuing to reduce operating expenses. With the acquisition of Splunk, Cisco hopes to expand its cybersecurity solutions, given Splunk’s security analytics and monitoring capabilities. The acquisition is expected to close in the third quarter of 2024, and we expect the shares to trade closer to the acquisition price of $157 as the closing date approaches.

Disclosures

Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

The Standard & Poor’s 500 (S&P 500) Index is a free-float weighted index that tracks the 500 most widely held stocks on the NYSE or NASDAQ and is representative of the stock market in general. It is a market value weighted index with each stock’s weight in the index proportionate to its market value.

The PCE price index (PCEPI), also referred to as the PCE deflator, PCE price deflator, or the Implicit Price Deflator for Personal Consumption Expenditures (IPD for PCE) by the BEA, and as the Chain-type Price Index for Personal Consumption Expenditures (CTPIPCE) by the Federal Open Market Committee (FOMC), is a United States-wide indicator of the average increase in prices for all domestic personal consumption. It is benchmarked to a base of 2012 = 100. Using a variety of data including U.S. Consumer Price Index and Producer Price Index prices, it is derived from the largest component of the GDP in the BEA’s National Income and Product Accounts, personal consumption expenditures.

Exchange Traded Funds (ETF’s) are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from the Fund Company or your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results.